Loading

Get Ca De 4453 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DE 4453 online

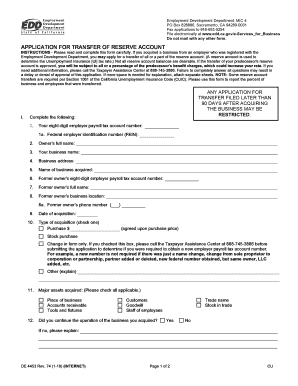

The CA DE 4453 form is essential for applying for a transfer of a reserve account after acquiring a business. This guide provides detailed instructions on how to complete the form online, ensuring a smooth application process.

Follow the steps to complete the CA DE 4453 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your eight-digit employer payroll tax account number in the designated field.

- Provide your federal employer identification number (FEIN) in the following field.

- Complete the owner’s full name section accurately.

- Input your business name in the respective field.

- Fill in your business address completely.

- Specify the name of the business you acquired.

- Include the former owner's eight-digit employer payroll tax account number.

- Provide the former owner's full name.

- Enter the business location of the former owner and their phone number.

- Input the date of acquisition accurately.

- Check the type of acquisition box that applies: purchase, stock purchase, or change in form.

- Indicate whether you have acquired major assets such as place of business, accounts receivable, etc.

- State if you continued the operation of the business acquired, providing explanations if necessary.

- Answer questions regarding common ownership or management at the time of transfer.

- Specify the number of workers employed by the seller before the sale.

- Input the number of the former owner's workers now employed by you.

- Indicate if you are a labor contractor or an employment agency, providing additional details if applicable.

- Complete the section regarding the portion of business acquired, ensuring clear communication of the request for reserve account transfer.

- Fill in the requested taxable wages for the specified years if the portion of the business requires it.

- List the name and phone number of a contact person for any further inquiries.

- Sign and date the application at the designated area before submitting.

- Once completed, review the entire form for accuracy. Save changes, download, print, or share the form as needed.

Start completing your CA DE 4453 form online for a seamless transition today.

Finding your Franchise Tax Board (FTB) ID number can be done by accessing your tax return documents or online account with the FTB. If you have trouble locating it, you can also contact the FTB directly for assistance. This number is important for completing various tax forms and should be noted when filling out the CA DE 4453.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.