Loading

Get Md Form-e 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

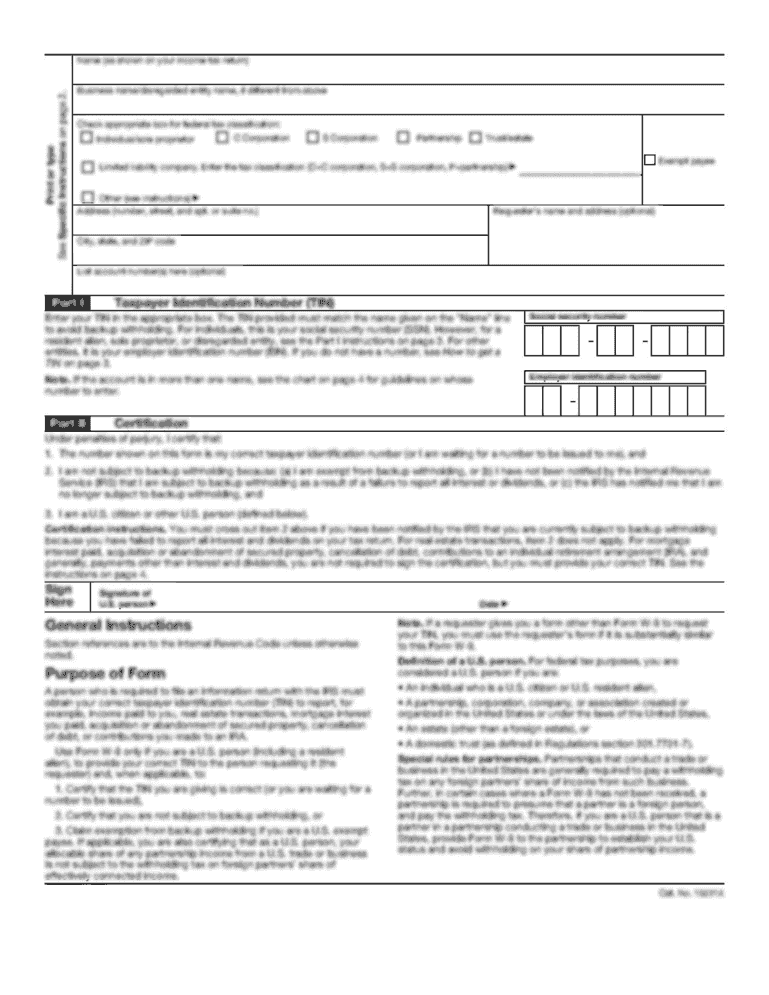

How to fill out the MD Form-E online

The MD Form-E is a crucial document for reporting lead-free inspections, ensuring compliance with lead safety regulations. This guide provides a thorough walkthrough for filling out the form online, making the process straightforward and accessible for all users.

Follow the steps to complete the MD Form-E effectively

- Click the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering the MDE tracking number, certificate number, inspector accreditation number, and the inspector's name in the designated fields.

- Input the MDE property number and the site address, ensuring to include the street number, street name, town, and zip code accurately.

- Complete the inspector contractor accreditation number and the contractor's name in the provided sections.

- In Section 1, 'Interior Surfaces', indicate the total number of units the certificate applies to, total XRF readings, number of units surveyed, total parcels, and total inconclusive XRF readings alongside the number of paint chip samples collected.

- In Section 2, 'Exterior Surfaces', select one option box indicating whether the exterior is lead-free or limited, and provide the required data regarding the number of XRF readings and inconclusive readings.

- In Section 3, 'Factory Applied Coatings on Metal Components', state the total number of paint chip samples collected and indicate whether the answer to the question posed is yes or no.

- Sign and date the form, marking the date certified lead-free appropriately.

- Review all information for accuracy before saving changes.

Ensure compliance by completing your documents online today.

Related links form

Filing a Maryland non-resident tax return involves using the appropriate forms that may differ from those used by residents. You will generally need to complete the MD Form-E for non-residents, detailing any Maryland-source income. Consult uslegalforms for comprehensive guides and templates that can simplify your filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.