Loading

Get Fl Ben-001 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL BEN-001 online

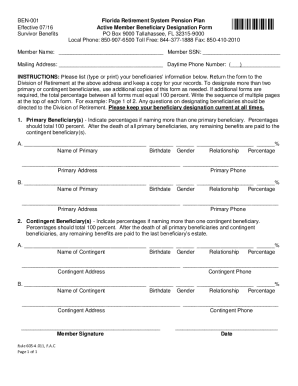

Filling out the FL BEN-001 form is essential for members of the Florida Retirement System who wish to designate or change their beneficiaries. This guide provides clear and detailed instructions to help you navigate the process effectively.

Follow the steps to complete the FL BEN-001 form.

- Press the ‘Get Form’ button to access the FL BEN-001 form and open it for editing.

- Begin filling out your member information, including your name, social security number, and mailing address. Ensure that all details are accurate and up-to-date.

- Provide your daytime phone number to facilitate any necessary communications regarding your application.

- Designate your primary beneficiaries. For each primary beneficiary, fill in their name, birthdate, gender, relationship to you, and the percentage of benefits they are to receive. Remember that the total percentage must equal 100 percent.

- If you have more than two primary beneficiaries, use additional copies of the form, ensuring to label each page sequentially (e.g., Page 1 of 2).

- Next, indicate your contingent beneficiaries in a similar manner as the primary beneficiaries. Again, provide their name, birthdate, gender, relationship, and percentage distribution of benefits.

- Sign and date the form to validate your beneficiary designation.

- Once completed, save the changes, download the form for your records, print it, or share it as needed. Ensure you return the original signed form to the Division of Retirement.

Complete your FL BEN-001 form online for a seamless beneficiary designation process.

When indicating the beneficiary percentage on the FL BEN-001 form, you should allocate the total shares among your beneficiaries without exceeding 100%. If you have multiple beneficiaries, consider how you want to divide your assets fairly. For example, you might assign 50% to one beneficiary and divide the remaining 50% between others. Clearly stating these percentages ensures your wishes are honored.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.