Get Mn Start Up Borrower Affidavit 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN Start Up Borrower Affidavit online

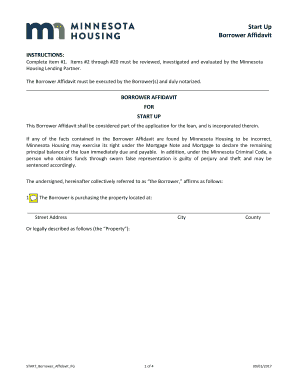

The MN Start Up Borrower Affidavit is a crucial form for individuals purchasing a property in Minnesota. This guide will assist you in completing the affidavit online, ensuring all required information is accurately provided for your loan application.

Follow the steps to complete the MN Start Up Borrower Affidavit online.

- Click the ‘Get Form’ button to access the affidavit and open it in your preferred online document editor.

- Begin with item #1, where you need to enter the property address, including the street address, city, and county.

- Continue to item #2 and confirm that you intend to occupy the property as your principal residence within the specified timeframe.

- In item #3, provide information indicating there are no intents to lease, sell, assign, or transfer any interest in the property.

- Review item #4 to ensure you have not entered any agreements concerning leasing or transferring the property.

- If applicable, for items #5 through #20, carefully read and respond to each statement, which pertains to ownership interest, financial arrangements, and usage of the property.

- Once you complete all items, ensure you have included accurate copies of any required documentation and agreements as mentioned throughout the affidavit.

- Finally, save the changes you have made to the affidavit. You can then choose to download, print, or share the completed form as required.

Complete your MN Start Up Borrower Affidavit online today to streamline your loan application process.

In Minnesota, down payment assistance can vary based on your specific circumstances and the program you qualify for. Typically, you can receive assistance ranging from a few thousand dollars up to $15,000, depending on your needs. The MN Start Up Borrower Affidavit is crucial in determining how much assistance you are eligible for, as it outlines your financial situation. Using services like UsLegalForms could help you navigate the paperwork and ensure you maximize your down payment assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.