Loading

Get In Sf 2837 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN SF 2837 online

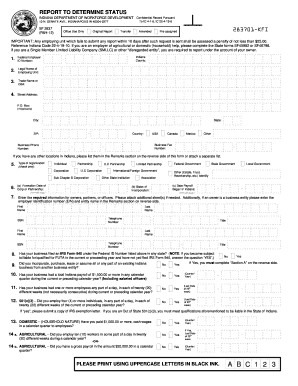

The IN SF 2837 form is essential for determining the employment status of a business in Indiana. This guide provides clear and supportive instructions on how to complete this form online.

Follow the steps to successfully complete the IN SF 2837 form.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the 'Federal Employer ID Number' in the provided field. Ensure that the number is accurate to avoid any processing issues.

- Enter the 'Legal Name of Employing Unit,' ensuring it matches your official business name.

- Provide your 'Trade Name' or 'Doing Business As' (DBA) if applicable.

- Complete the 'Street Address,' along with the city, county, state, and ZIP code for your business location.

- Indicate your type of organization by checking the appropriate box (e.g., corporation, partnership, LLC).

- Fill in the 'Formation Date of Corp or Partnership' and the state of incorporation.

- Provide details for owners, partners, or officers, including first name, last name, SSN, title, and telephone number. Attach additional sheets if necessary.

- Answer the questions regarding IRS filings and previous business transactions by selecting 'Yes' or 'No' as applicable.

- Complete Section A if you have purchased or otherwise acquired an existing business in Indiana.

- Review all entered information for accuracy before proceeding.

- Once all sections are completed, save the changes, and choose to download, print, or share the completed form as needed.

Complete the IN SF 2837 online today to fulfill your reporting obligations efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can find information about SUTA by visiting the Indiana Department of Workforce Development's website. They offer resources and guidance regarding your SUTA obligations. For comprehensive assistance, consider utilizing the uslegalforms platform, which can help you navigate the intricacies of IN SF 2837.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.