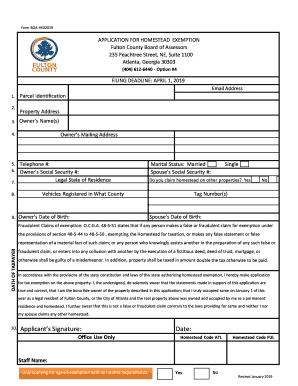

Get Ga Application For Basic Homestead Exemption - Fulton County 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA Application for Basic Homestead Exemption - Fulton County online

Filing for a homestead exemption can help reduce your property tax burden. This guide provides clear instructions on how to complete the GA Application for Basic Homestead Exemption for Fulton County online, ensuring you have all the necessary information to submit your application successfully.

Follow the steps to fill out the application form smoothly.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your parcel identification number in the designated field. This information can usually be found on your property tax statement.

- Next, provide the property address where your homestead exemption will be applied. Ensure that the information matches the official records.

- Enter your name or names as the owner(s) of the property. Please make sure to use the full legal names as listed on documentation.

- Fill in your mailing address. If it is the same as your property address, indicate that accordingly.

- Input your phone number in the specified format, ensuring it is one that you regularly check.

- Provide your Social Security number. Make sure to keep this information secure.

- Indicate your legal state of residence, confirming that you reside in Georgia.

- Specify the county where your vehicles are registered. This is important for verification purposes.

- Enter your date of birth and marital status. If married, provide your spouse's Social Security number and date of birth as well.

- Answer the question regarding claims on other properties. This helps to ensure that you are not claiming exemptions on multiple properties.

- Review the Oath of Taxpayer section carefully. You must affirm that the information provided is true and correct.

- Sign and date the application in the designated area. This signature is a legal affirmation of the information provided.

- Once all fields are filled out accurately, you can save your changes, download, print, or share the completed form as needed.

Complete your application online today and ensure your homestead exemption is processed without delay.

The savings from a homestead exemption can vary widely based on property value and location. Many homeowners experience savings between several hundred to thousands of dollars each year, depending on their situation. By submitting the GA Application for Basic Homestead Exemption - Fulton County, you can take the first step toward realizing these potential savings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.