Loading

Get Za Sars Fia 001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZA SARS FIA 001 online

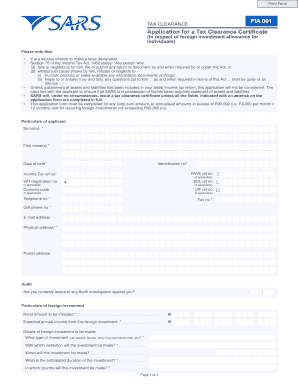

Filling out the ZA SARS FIA 001 form is crucial for individuals seeking a tax clearance certificate for foreign investment allowances. This guide provides a step-by-step approach to completing the form accurately and efficiently.

Follow the steps to complete the ZA SARS FIA 001 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Particulars of applicant' section, fill in your surname, first names, date of birth, identification number, income tax reference number, PAYE reference number, VAT registration number, SDL reference number, customs code, UIF reference number, telephone number, fax number, cell phone number, email address, physical address, and postal address. Ensure all fields marked with an asterisk are completed.

- Indicate whether you are currently aware of any audit investigation against you by selecting 'Yes' or 'No.'

- In 'Particulars of foreign investment,' enter the rand amount to be invested and the expected annual income from this foreign investment. Provide details about the investment type, institution, anticipated date, duration, and country.

- Complete the 'Other details of investment' section by selecting the source of the capital to be invested. Attach the required documentation for each option chosen.

- Confirm whether you have attached a detailed statement of assets and liabilities to your latest IT12 Income Tax return by selecting 'Yes' or 'No.' If 'No,' attach the copy as instructed.

- In the 'Declaration' section, affirm that the information and supporting documents provided are true and correct. You will also need to declare any income earned from the foreign investments in your annual income tax returns.

- For the 'Appointment of representative/agent,' fill in the name of the individual you are authorizing to apply and receive the tax clearance certificate on your behalf.

- Lastly, provide the details of the agent or bank that will handle the transfer of funds on your behalf, including their name, telephone number, fax number, email address, and postal address.

- After reviewing all entered information for accuracy, you can save your changes, download, print, or share the completed form as needed.

Complete your ZA SARS FIA 001 form online today for a seamless application process.

The foreign currency allowance for SARS permits individuals to hold a specific amount of foreign currency for various purposes like travel and international purchases. This allowance is crucial for South Africans aiming to manage their finances internationally. Stay informed about the ZA SARS FIA 001 to understand how to make the most out of these provisions for your financial advantage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.