Loading

Get Uk Hmrc Sa900 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC SA900 online

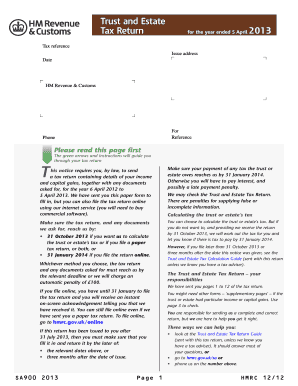

The UK HMRC SA900 is a crucial tax return form for trusts and estates. This guide will help you navigate through each section of the form to ensure accurate completion, especially when filing online.

Follow the steps to successfully complete the UK HMRC SA900 online.

- Press the ‘Get Form’ button to acquire the form and access it in the appropriate editor.

- Begin by reviewing the introductory guidelines provided on the form to understand your obligations fully.

- Complete the tax reference, issue address, and contact details in the initial section of the form. Ensure that all information is accurate and up-to-date.

- Follow the prompts and answer the questions regarding income and capital gains. Be particularly attentive to specific instructions that may direct you to skip sections if certain criteria are met.

- If applicable, obtain and complete any supplementary pages needed to provide additional details about income or gains.

- Address the sections on claiming reliefs and deductions carefully. Ensure all boxes are filled correctly based on the income types you have reported.

- Review completion metrics, ensuring all fields are appropriately filled out, and that you have met all criteria mentioned throughout the form.

- Finalize your submission by saving the document, and choose to download or print it as needed. Ensure to share it promptly if required.

Get started with your online tax return by filing the UK HMRC SA900 today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Placing your house in a trust can be a strategy to manage potential Inheritance Tax in the UK, but it requires careful planning. When establishing a trust, ensure that you follow the proper procedures and file the UK HMRC SA900 as required. Consulting with a legal expert can help you navigate the complexities of trusts and taxes effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.