Loading

Get Uk Hmrc Rd1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC RD1 online

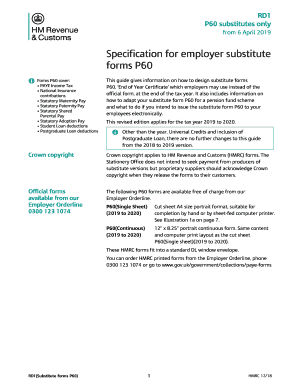

This guide provides comprehensive instructions on filling out the UK HMRC RD1 form online. The RD1 form is used by employers to create substitute forms P60, which are essential documents for summarizing employees’ pay and tax contributions at the end of the tax year.

Follow the steps to complete the UK HMRC RD1 form effectively.

- Click ‘Get Form’ button to obtain the RD1 form and open it for editing.

- Ensure you understand the components of the substitute P60 that you need to include in your RD1. It is crucial to incorporate all legal information such as employee details, pay, tax deducted, and National Insurance contributions that must be displayed on the final form.

- Design the structure of your substitute form according to HMRC guidelines. Include headings and essential information like the tax year, employee's name, payroll number, PAYE reference, and final tax code.

- Once you have designed your RD1 form, prepare a draft version and email it to hmrc.substituteformsapproval@hmrc.gsi.gov.uk for approval. Remember to include your unique identifier in the form number as per HMRC requirements.

- Await the HMRC's feedback or approval. Submit the draft as early as possible, especially before 1 March, to avoid delays. It is advisable to prepare and send early drafts, particularly from November through April, as that period is busy for HMRC.

- After receiving approval, ensure all formats and layouts comply with legal requirements. Include all the necessary sections like National Insurance bands and statutory payments accurately.

- Finally, save changes to the form. Options are available to download, print, or share the filled RD1 form with relevant employees once it is finalized.

Start completing your UK HMRC RD1 form online today to ensure compliance and efficiency.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To request a U1 form in the UK, you need to contact HMRC or your local Jobcentre Plus. The U1 form is important if you are looking to claim benefits in another EU country. Make sure to have your personal details ready for a smooth request process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.