Loading

Get Uk Hmrc Iht405 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC IHT405 online

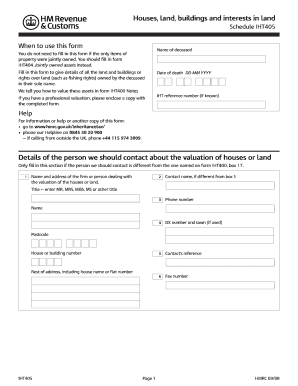

Filling out the UK HMRC IHT405 form accurately is essential for reporting the deceased's land, buildings, and interests in land. This guide provides clear, user-friendly instructions to help you complete the form online with confidence.

Follow the steps to fill out your IHT405 form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the deceased in the designated field, ensuring you also include their date of death in the format DD MM YYYY.

- If applicable, provide the IHT reference number if you have it available.

- Complete the contact information section, filling in the details of the person who should be contacted regarding the valuation of the properties.

- In the property details section, list each item of property owned by the deceased in their sole name. Number each item and provide a full address or description.

- Specify the tenure of each property, indicating whether it is freehold or leasehold. If leasehold, include the number of years remaining on the lease and the annual ground rent.

- If the property was let, provide details such as tenancy dates, rent payable, and tenant information while attaching any related lease documents.

- Should you be claiming any reliefs, document the corresponding values for agricultural, business, or woodlands relief in the designated fields.

- Indicate if any special factors might affect property values, providing necessary reports or correspondence concerning damages or insurance claims.

- Record details about any properties sold or intended for sale within 12 months of the date of death, including asking prices and sale specifics.

- Once all sections are completed, double-check the form for accuracy before saving your changes, as well as downloading, printing, or sharing the completed document.

Take the first step in managing your documents online by completing your IHT405 today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In the UK, declaring inheritance on your tax return is required if the inherited assets produce income. While the inheritance itself may not be taxed, earnings generated from that inheritance must be reported. For clear instructions, consult the UK HMRC IHT405 guidelines to navigate your responsibilities confidently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.