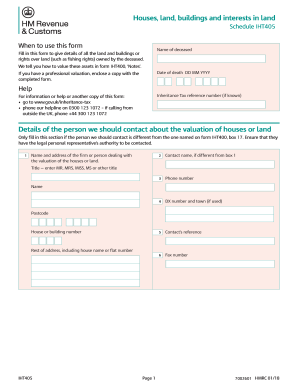

Get Uk Hmrc Iht405 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UK HMRC IHT405 online

How to fill out and sign UK HMRC IHT405 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Selecting a legal specialist, arranging a planned appointment, and attending the office for a face-to-face meeting makes completing a UK HMRC IHT405 from beginning to end tiring.

US Legal Forms assists you in quickly generating legally-compliant documents based on pre-designed online templates.

Quickly create a UK HMRC IHT405 without having to involve professionals. We already have over 3 million clients taking advantage of our extensive collection of legal documents. Join us today and gain access to the premier library of online templates. Experience it yourself!

- Locate the UK HMRC IHT405 you need.

- Access it using the cloud-based editor and start modifying.

- Fill in the blank fields: involved parties' names, residences, and numbers, etc.

- Personalize the template with intelligent fillable fields.

- Insert the specific date and place your electronic signature.

- Simply click Done after verifying all the information.

- Download the ready-made document to your device or print it as a hard copy.

How to modify Get UK HMRC IHT405 2018: personalize documents online

Authorize and distribute Get UK HMRC IHT405 2018 alongside any other professional and personal documents online without squandering time and resources on printing and mailing. Maximize the benefits of our online document editor with an integrated compliant eSignature feature.

Signing and submitting Get UK HMRC IHT405 2018 forms electronically is faster and more efficient than handling them on paper. Nevertheless, it requires utilizing online services that guarantee a high level of data security and furnish you with a certified tool for creating eSignatures. Our powerful online editor is precisely what you need to prepare your Get UK HMRC IHT405 2018 and other individual and business or tax documents in an accurate and proper manner in accordance with all regulations. It provides all necessary tools to swiftly and easily complete, modify, and sign paperwork online and include Signature fields for additional parties, indicating who and where should sign.

It requires just a few simple steps to complete and sign Get UK HMRC IHT405 2018 online:

When approving Get UK HMRC IHT405 2018 with our comprehensive online solution, you can always be assured that it is legally binding and admissible in court. Prepare and submit documents in the most efficient manner possible!

- Open the chosen file for further management.

- Utilize the upper toolbar to insert Text, Initials, Image, Check, and Cross symbols into your document.

- Highlight the critical information and obscure or delete the sensitive parts if necessary.

- Press the Sign option above and determine how you wish to eSign your document.

- Sketch your signature, type it, upload its image, or choose an alternative method that works for you.

- Proceed to the Edit Fillable Fields panel and position Signature fields for others.

- Click on Add Signer and enter your recipient’s email to assign this field to them.

- Ensure that all information provided is complete and accurate before you click Done.

- Distribute your documents with others using one of the available methods.

Creating a trust can effectively mitigate inheritance tax by removing assets from your estate. Trusts allow you to pass on property without increasing the taxable estate's value, often resulting in lower taxes for beneficiaries. Consulting resources or experts familiar with the UK HMRC IHT405 can enhance your understanding of trust benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.