Loading

Get Uk Hmrc C&e1179 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC C&E1179 online

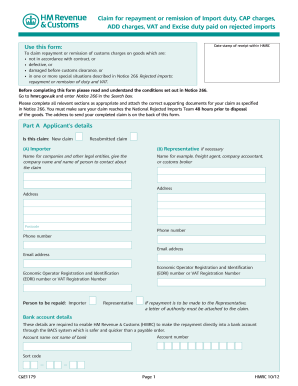

The UK HMRC C&E1179 form is essential for individuals and organizations seeking repayment or remission of customs charges on rejected imports. This guide provides a detailed, step-by-step process to assist users in successfully completing the form online, ensuring all necessary information is accurately provided.

Follow the steps to complete the UK HMRC C&E1179 form online.

- Press the ‘Get Form’ button to obtain the C&E1179 form and open it in your preferred online editor.

- Begin by filling out Part A with the applicant’s details. Indicate whether this is a new or resubmitted claim. Input the name of the importer and, if applicable, the representative handling the claim.

- Provide the relevant address, postcode, phone number, and email address for the applicant or representative.

- Include the Economic Operator Registration and Identification (EORI) number or VAT registration number as required.

- Specify who is to be repaid—either the importer or the representative. If repayment is directed to the representative, attach a letter of authority with your claim.

- Complete the bank account details needed for HMRC to process the repayment directly via the BACS system, including the account name, account number, and sort code.

- In Part B, detail the reason for rejection of the goods. Indicate whether the goods were not as per contract, defective, or damaged before customs.

- Provide the entry details, including entry date and entry number, and indicate the method of disposal of the goods.

- In Part C, tick the boxes for the supporting documents you are including with your claim, as specified in Notice 266.

- In Part D, select the appropriate boxes to indicate which duties and VAT you are claiming repayment or remission for and specify the amounts.

- Complete the declaration by signing and providing the date. Ensure all answers are accurate.

- Finally, submit your completed C&E1179 form along with the supporting documents to the National Rejected Imports Team at the specified address.

Complete your UK HMRC C&E1179 form online today to ensure a smooth claims process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Indeed, you can claim back duty on imports in the UK under specific circumstances. When items are returned or if there was an error in duty calculation, you can seek a refund. The UK HMRC C&E1179 form is essential for this process, as it provides the necessary details for your claim.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.