Loading

Get Uk Hmrc Apss255 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC APSS255 online

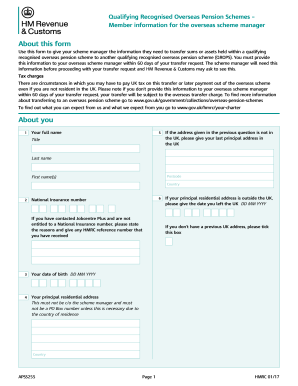

Filling out the UK HMRC APSS255 form correctly is essential for transferring your pension to a qualifying recognised overseas pension scheme. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the APSS255 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor. This allows you to start your application seamlessly.

- Provide your full name, including your first name(s) and last name. Ensure this information matches your identification documents.

- Enter your date of birth in the format DD MM YYYY. This information is necessary for verifying your identity.

- Fill in your principal residential address. This cannot be a P.O. Box number unless required due to your country of residence.

- If applicable, indicate the date you left the UK, following the format DD MM YYYY, if your address is outside the UK.

- Provide your National Insurance number. If you are unable to provide one, specify the reasons and include any HMRC reference number if available.

- Input the HMRC reference number for the QROPS you are transferring to. This is essential for the scheme manager to identify your transfer.

- Indicate whether the receiving QROPS is an occupational pension scheme and provide the name and address of the QROPS.

- Select the country where the QROPS is established and regulated.

- Complete your employment details, including your employer's name, job title, and the date your employment began in DD MM YYYY format.

- If you have a payroll tax reference number, please include it. Otherwise, continue with the next questions.

- Confirm whether you have been informed of accessing some or all of the transfer value before the age of 55 and sign the form, ensuring your signature is dated.

Take the next step towards managing your pension by completing the APSS255 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To notify HMRC that you have left the UK, you should complete the P85 form. This form captures your departure details and provides HMRC the necessary information to adjust your tax status under the UK HMRC APSS255 rules. You can submit it online or through the mail. Remember, keeping your records updated is essential for avoiding tax complications.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.