Loading

Get Uk Hmrc C110 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC C110 online

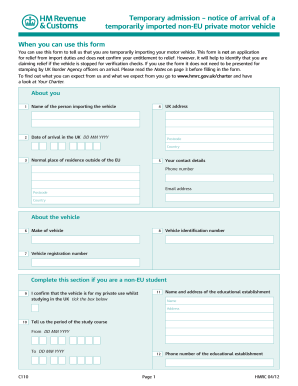

The UK HMRC C110 form is essential for individuals temporarily importing a non-EU private motor vehicle. This guide provides a structured approach to completing the form online, ensuring all necessary details are accurately filled out.

Follow the steps to successfully complete the UK HMRC C110 form

- Press the ‘Get Form’ button to access the online version of the UK HMRC C110 form.

- Fill in your personal information, including the name of the person importing the vehicle, their address in the UK, and the date of arrival in the UK.

- Provide the normal place of residence outside of the EU, including the country and postal code.

- Input your contact details, including phone number and email address.

- Complete the vehicle information section by entering the make of the vehicle, the Vehicle Identification Number (VIN), and the vehicle registration number.

- If applicable, fill out the section for non-EU students or residents by confirming the vehicle is for private use during your studies or work contract and providing relevant dates.

- If you are re-exporting the vehicle, wait until the vehicle is ready for re-exportation before entering the date of re-exportation.

- Review all the information provided to ensure accuracy and completeness.

- Once all sections are completed, save any changes, and proceed to download, print, or share the form as necessary.

Complete your UK HMRC C110 form online today to ensure your temporary admission is properly documented.

To re-import a car to the UK, first, gather all forms of documentation, including proof of previous registration and ownership. You must then inform the UK HMRC C110 about your plans to re-import the vehicle. Completing the registration and paying any taxes will ensure compliance with UK laws. This will allow you to use your vehicle legally in the UK once more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.