Get Ph Bir 2000 1999-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 2000 online

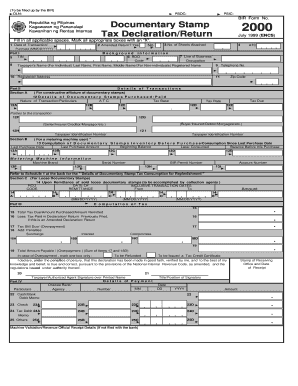

Filling out the PH BIR 2000 form online is a crucial step for ensuring compliance with the documentary stamp tax regulations in the Philippines. This guide provides a step-by-step approach tailored to assist users of all experience levels in accurately completing this important document.

Follow the steps to successfully fill out the PH BIR 2000 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- In the top section, enter the Documentary Stamp Tax Declaration/Return details. Fill in the applicable spaces, including the Date of Transaction, Number of Sheets Attached, and the Amended Return option if applicable.

- Enter the Background Information. Include your Taxpayer Identification Number (TIN), the Revenue District Office (RDO) code, your Line of Business or Occupation, Taxpayer’s Name, Registered Address, and Telephone Number.

- Proceed to the Details of Transactions section. Here, record the details of the documentary stamps purchased, including Nature of Transaction, Tax Base, Tax Rate, and Tax Due. Ensure all appropriate boxes are marked with an 'X'.

- Complete the Computation of Documentary Stamps Inventory section, detailing your inventory before purchasing, including Last Purchase Amount, Amount Consumed, and Balance.

- If applicable, fill out the Metering Machine Information with relevant details, such as Machine Brand, Serial Number, BIR Permit Number, and Account Number.

- In the Computation of Tax section, calculate the Total Tax Due, and include any previous tax paid if this is an amended return. Don’t forget to add any penalties or interest applicable.

- Review the declaration statement and provide your signature over your printed name. Include your Title/Position and Date.

- Finally, check all the filled details for accuracy. You can now save changes, download, print, or share the completed form as needed.

Complete your PH BIR 2000 form online today to ensure compliance and streamline your tax submissions.

A documentary stamp certifies that a specific transaction has been taxed appropriately according to the law. It acts as proof that you have fulfilled your tax obligations for different legal documents, ensuring validity and legal enforceability. By utilizing a documentary stamp, you protect yourself and your transactions, adding a layer of security. This is especially vital when dealing with the requirements related to the PH BIR 2000.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.