Loading

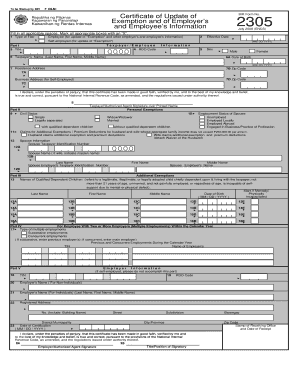

Get Ph Bir 2305 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 2305 online

The PH BIR 2305 form is essential for updating exemption and information for both employers and employees in the Philippines. This guide provides a clear, step-by-step approach to help users fill out the form online accurately and efficiently.

Follow the steps to complete the PH BIR 2305 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your taxpayer identification number (TIN) in Part I, field 3. This is a crucial identifier for tax purposes.

- Select the type of filer by marking the appropriate box in field 1. Choose between ‘Employee’ or ‘Self-employed’ based on your status.

- Provide the effective date in field 2 using the format MM/DD/YYYY to indicate when any exemptions are applicable.

- Fill out your personal information including your sex, name, date of birth, and residence address in fields 5 to 7.

- In Part II, specify your civil status in field 9 and proceed to complete any relevant fields regarding personal exemptions.

- For users with dependents, complete Part III by providing the names and relevant details of qualified dependent children in fields 13A to 16E.

- If you have multiple employments, indicate the type and enter employer information in Part IV, including TINs and names of employers.

- Complete Part V if you are filling this form on behalf of an employer; provide employer details in fields 18 to 24.

- Review all filled fields for accuracy, sign in the indicated area, and date the certification in the relevant field before submission.

- Finally, save your changes, and you may choose to download, print, or share the completed form as needed.

Start filling out your PH BIR 2305 online today for a smoother documentation process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To submit the alphalist to BIR online, you must first prepare your alphalist data in accordance with BIR guidelines. You then log into the BIR's e-filing system, where you can upload your file. Using PH BIR 2305 ensures that your submissions are accurate and up-to-date, making the online process smoother and more efficient.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.