Loading

Get Md Comptroller 515 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 515 online

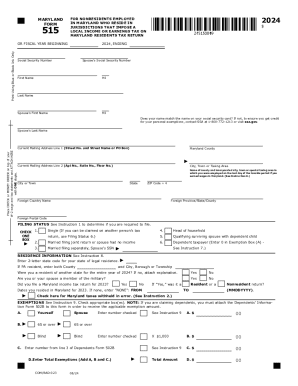

Completing the MD Comptroller 515 form online is a straightforward process tailored to nonresidents employed in Maryland who reside in jurisdictions imposing local income tax. This guide will provide you with clear and thorough steps to ensure your form is filled out correctly and efficiently.

Follow the steps to complete the MD Comptroller 515 successfully.

- Click ‘Get Form’ button to access the MD Comptroller 515 online. This will allow you to view and edit the form in your preferred format.

- Enter your personal information, including your name and Social Security number (SSN) along with your spouse’s details if applicable. Ensure your name matches the name on your Social Security card, as discrepancies may affect your tax exemptions.

- Select your filing status by checking the appropriate box. This should correspond to your status on your federal tax return, with specific options for residents or dependents.

- Document all sources of income under the income and adjustments section, making sure to categorize your income correctly in the federal, Maryland, and non-Maryland columns.

- After computing your tax using the provided tax rates or tables, fill in the total amounts and any credits applicable to you.

- Finally, after filling out the form, you may choose to save, download, print, or share the completed MD Comptroller 515 form as needed.

Complete your MD Comptroller 515 form online today to ensure accurate filing and avoid potential penalties.

You can pay your Maryland taxes with a personal check, money order or credit card. You may also choose to pay by direct debit when you file electronically. If you file and pay electronically by April 15, you have until April 30 to make the electronic payment, using direct debit or a credit card.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.