Loading

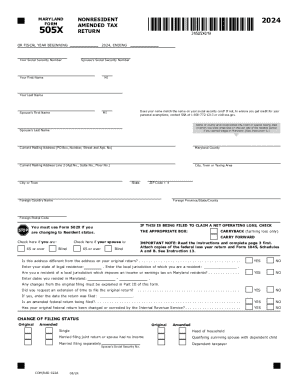

Get Md Comptroller 505x 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 505X online

Filling out the MD Comptroller 505X online can streamline your process for submitting a nonresident amended tax return. This guide provides clear, step-by-step instructions to help you accurately complete the form, ensuring that your details are submitted correctly and efficiently.

Follow the steps to confidently complete your MD Comptroller 505X online.

- Press the ‘Get Form’ button to access the MD Comptroller 505X and open it in your document editor.

- Enter your Social Security number and your spouse's Social Security number, if applicable. Ensure that the entered names match those on your Social Security cards.

- Provide your first name, middle initial, last name, and indicate if this name matches the name on your Social Security card.

- Input your current mailing address, including any relevant PO Box details, city, state, and zip code. If you are using a foreign address, ensure to complete foreign country fields as well.

- Indicate whether you are using this form to claim a net operating loss. Also, check if you or your spouse is 65 or older or blind, if applicable.

- Complete questions regarding any changes from your original filing, such as residence dates in Maryland, and provide explanations for any amendments in Part III.

- Fill out your federal adjusted gross income, additions to income, and subtractions from income using the correct figures from your federal return.

- Calculate your Maryland adjusted gross income and determine if you are using the standard deduction or itemized deduction method.

- Enter all required credits and contributions. Make sure to document any adjustments in the itemization section and the form's Part II.

- Review your completed form for accuracy, then save your changes, and choose to either download, print, or share the form as needed before submission.

Complete your MD Comptroller 505X online today to ensure you meet your tax obligations accurately.

You may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. - 4:30 p.m., Monday through Friday. If you are sending a Form 502 or Form 505 (with a payment) through the US Postal Service, send it to: Comptroller of Maryland, Payment Processing, PO Box 8888, Annapolis, MD 21401-8888.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.