Loading

Get Form 400 Itr 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 400 ITR online

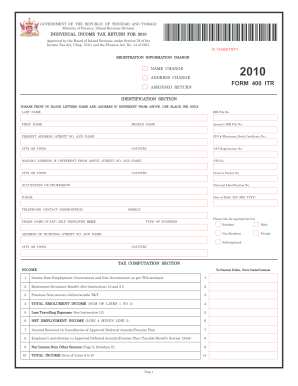

The Form 400 Individual Income Tax Return is an essential document for reporting income and calculating tax liabilities. This guide provides a step-by-step process to assist users in completing the form online with ease and accuracy.

Follow the steps to fill out the Form 400 ITR online effectively.

- Press the ‘Get Form’ button to acquire the form and open it in the editor.

- Begin with the identification section, providing your last name, first name, and middle name as required. If your name or address has changed from the previous year, ensure to fill out the respective fields accurately.

- Complete the present address section, including street number and name, city or town, and country. If your mailing address differs, fill in that information as well.

- In the income section, report your income from employment, pensions, and any other sources as outlined in the form. Ensure to total your emolument income.

- Deduct any allowable expenses from your total income as specified. This includes expenses related to tertiary education and any personal allowances.

- Proceed to calculate your chargeable income by subtracting total deductions from your assessable income.

- Finalize by reviewing your tax calculations, including any applicable credits or liabilities based on the income tax rates provided.

- Once completed, save your changes. You may choose to download, print, or share the form as required.

Complete your Form 400 ITR online today for a seamless tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out a Form 400 ITR requires you to provide information about your income, deductions, and credits. Start by gathering all necessary documents, such as W-2 forms and 1099s. Carefully follow the instructions on the form to ensure accurate completion. For added ease and confidence, consider using the US Legal Forms platform, which offers resources and support for filling out the form correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.