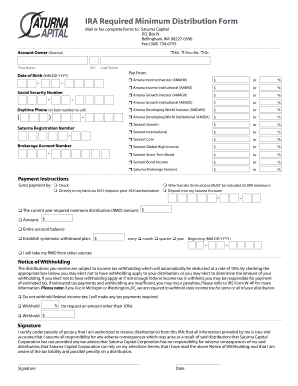

Get Ira Required Minimum Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign IRA Required Minimum Distribution Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Are you searching for a fast and practical solution to fill in IRA Required Minimum Distribution Form at an affordable price? Our service will provide you with a rich selection of forms that are available for filling in online. It takes only a few minutes.

Stick to these simple steps to get IRA Required Minimum Distribution Form completely ready for sending:

- Find the sample you need in our library of legal forms.

- Open the form in our online editor.

- Read through the guidelines to learn which info you need to include.

- Choose the fillable fields and include the requested information.

- Put the date and place your electronic signature as soon as you complete all other fields.

- Double-check the form for misprints as well as other mistakes. If you need to correct some information, the online editor and its wide range of tools are at your disposal.

- Save the resulting document to your gadget by hitting Done.

- Send the electronic form to the parties involved.

Filling in IRA Required Minimum Distribution Form doesn?t need to be stressful anymore. From now on easily get through it from home or at the place of work right from your smartphone or personal computer.

Tips on how to fill out, edit and sign IRA Required Minimum Distribution Form online

How to fill out and sign IRA Required Minimum Distribution Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Are you searching for a fast and practical solution to fill in IRA Required Minimum Distribution Form at an affordable price? Our service will provide you with a rich selection of forms that are available for filling in online. It takes only a few minutes.

Stick to these simple steps to get IRA Required Minimum Distribution Form completely ready for sending:

- Find the sample you need in our library of legal forms.

- Open the form in our online editor.

- Read through the guidelines to learn which info you need to include.

- Choose the fillable fields and include the requested information.

- Put the date and place your electronic signature as soon as you complete all other fields.

- Double-check the form for misprints as well as other mistakes. If you need to correct some information, the online editor and its wide range of tools are at your disposal.

- Save the resulting document to your gadget by hitting Done.

- Send the electronic form to the parties involved.

Filling in IRA Required Minimum Distribution Form doesn?t need to be stressful anymore. From now on easily get through it from home or at the place of work right from your smartphone or personal computer.

How to edit IRA Required Minimum Distribution Form: customize forms online

Sign and share IRA Required Minimum Distribution Form along with any other business and personal documentation online without wasting time and resources on printing and postal delivery. Take the most out of our online document editor using a built-in compliant eSignature tool.

Signing and submitting IRA Required Minimum Distribution Form documents electronically is quicker and more effective than managing them on paper. However, it requires using online solutions that ensure a high level of data safety and provide you with a compliant tool for generating eSignatures. Our robust online editor is just the one you need to complete your IRA Required Minimum Distribution Form and other individual and business or tax forms in a precise and suitable manner in accordance with all the requirements. It offers all the essential tools to easily and quickly complete, modify, and sign documentation online and add Signature fields for other parties, specifying who and where should sign.

It takes just a few simple steps to fill out and sign IRA Required Minimum Distribution Form online:

- Open the chosen file for further processing.

- Use the top toolbar to add Text, Initials, Image, Check, and Cross marks to your sample.

- Underline the key details and blackout or remove the sensitive ones if needed.

- Click on the Sign tool above and choose how you want to eSign your sample.

- Draw your signature, type it, upload its picture, or use an alternative option that suits you.

- Switch to the Edit Fillable Fileds panel and place Signature fields for other parties.

- Click on Add Signer and enter your recipient’s email to assign this field to them.

- Check that all information provided is complete and precise before you click Done.

- Share your document with others using one of the available options.

When signing IRA Required Minimum Distribution Form with our comprehensive online solution, you can always be certain you get it legally binding and court-admissible. Prepare and submit documents in the most effective way possible!

To calculate your required minimum distribution from an IRA, you first need to determine your account balance as of December 31 of the previous year. Next, divide this amount by a life expectancy factor, which you can find in IRS tables. This calculation can be complex, but using the IRA Required Minimum Distribution Form simplifies the process, ensuring you meet IRS requirements. You can also utilize online calculators or professional services to assist you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.