Get India Kotak Mahindra Bank Form 15h 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Kotak Mahindra Bank Form 15H online

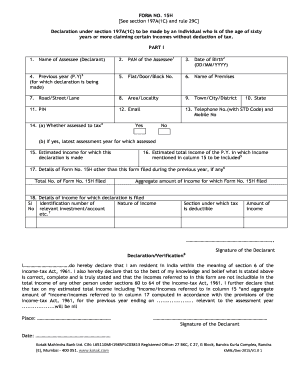

Filling out the India Kotak Mahindra Bank Form 15H online is a straightforward process that allows individuals aged sixty or more to declare certain incomes without tax deduction. This guide provides a clear, step-by-step approach to ensure accurate completion of the form.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, enter your full name as the Assessee (Declarant).

- Provide your Permanent Account Number (PAN). This is crucial for the validity of the form.

- Input your date of birth in the format DD/MM/YYYY.

- Indicate the previous year for which you are making this declaration.

- Fill in your flat, door, or block number.

- Enter the name of the premises where you reside.

- Provide the road, street, or lane details.

- Specify your area or locality.

- Input the town, city, or district name.

- Indicate the PIN code for your address.

- Enter your email address for communication.

- Provide your telephone number along with the STD code and mobile number.

- Answer whether you have been assessed to tax by selecting 'Yes' or 'No'. If 'Yes', specify the latest assessment year.

- State the estimated income for which this declaration is made.

- Indicate the estimated total income for the previous year that includes the income mentioned earlier.

- If applicable, provide details of any other Form No. 15H filed during the previous year, including total number and aggregate income.

- List the details of the income for which the declaration is filed, including identification numbers and the nature of income.

- Complete the declaration/verification section by signing and dating the document.

- Review all entries for accuracy, then save your changes, download, print, or share the completed form as needed.

Complete your India Kotak Mahindra Bank Form 15H online today and ensure a smooth filing process.

Filling out a 15H form involves providing your personal details, like name, address, and PAN number. You will also need to state your total annual income, ensuring it aligns with the thresholds for tax exemption. Submitting an accurately completed Form 15H through your bank can significantly simplify your tax situation, similar to the India Kotak Mahindra Bank Form 15H process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.