Loading

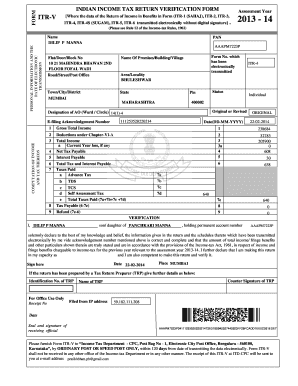

Get India Itr-v 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India ITR-V online

The India ITR-V is a crucial document required for income tax verification. Understanding how to accurately complete this form online can simplify the process and ensure compliance with the Income Tax Department.

Follow the steps to fill out the ITR-V form accurately.

- Press the ‘Get Form’ button to obtain the ITR-V form and open it in the designated editor.

- Begin by entering the assessment year corresponding to the return of income, ensuring accuracy in the year format.

- Fill in your personal details, including your name as registered, permanent account number (PAN), and your address, specifying flat number, street, town or city, district, state, and pin code.

- Indicate the form number that has been electronically transmitted, for instance, ITR-4.

- Select whether the submission is original or revised by marking the appropriate option.

- Enter the gross total income and detail your deductions under Chapter-VI-A, followed by total income computation.

- Calculate net tax payable and any interest payable, ensuring all entries align with the income details provided.

- Detail the total tax and interest payable, and document the taxes paid through advance tax, TDS, TCS, or self-assessment tax.

- Compute the refund amount if applicable, or clearly state the tax payable.

- Complete the verification section by declaring the truthfulness of the information submitted, sign and date the form, and note the place of declaration.

- If prepared by a tax return preparer, include their identification number and details.

- Finalize by reviewing all data, making necessary corrections, and then save the form. You can download, print, or share it as needed.

Complete the ITR-V form online to ensure your tax filing is accurate and compliant.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

As an NRI, you may still need to file a tax return in India based on your income sources. If your income exceeds the tax exemption limit, you must file your return, including your ITR-V. It's essential to stay compliant with Indian tax laws while managing your global income.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.