Loading

Get India Gst Mov-01

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India GST MOV-01 online

This guide provides a clear and supportive overview for users looking to fill out the India GST MOV-01 form online. It breaks down each section to assist you in providing accurate information, ensuring compliance with the GST requirements.

Follow the steps to complete the India GST MOV-01 form online.

- Click the 'Get Form' button to obtain the form and access it in your preferred online format.

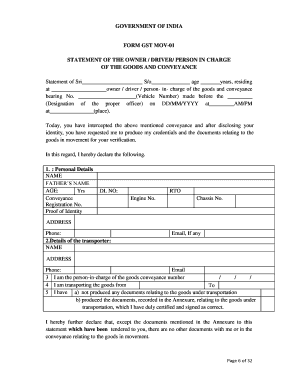

- In the first section, enter your personal details. Fill in your name, age, and address. Additionally, provide the vehicle registration number, driving license number, engine number, and chassis number. It is essential to ensure that all information is accurate and clearly written.

- Complete the details of the transporter section by providing the transporter's name, address, email (if applicable), and phone number. This information identifies the party responsible for the goods being transported.

- Indicate your role concerning the goods either as the owner, driver, or person in charge of the conveyance. Ensure you accurately reflect your relationship with the goods and the vehicle.

- Specify the locations for transportation by filling in where the goods are being transported from and to. This helps in determining the logistics involved.

- Declare whether you have produced documents relating to the goods under transportation by checking the appropriate option. If documents are produced, ensure you attach them as outlined in the Annexure and confirm they are duly certified.

- At the end of the document, review the statement you are making, ensuring all information is truthful and correct. Enter the language in which the statement was explained to you. Then, sign alongside your designation.

- To finalize the process, save your changes, download the completed form, and choose to print or share it as necessary. Make sure you keep a copy for your records.

Start filing your documents online to ensure compliance and efficiency in your GST process.

You can file your GST return online through the official GST portal, which is designed to streamline the filing process. After logging in, you'll find sections dedicated specifically to GST return filing, giving you clear guidance throughout. Utilizing resources from platforms like US Legal Forms can help demystify the process associated with India GST MOV-01.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.