Loading

Get India Form 103-gd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Form 103-GD online

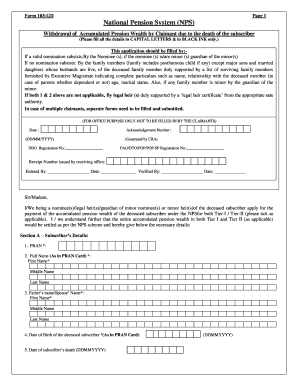

This guide provides clear instructions on how to fill out the India Form 103-GD online, which is used for the withdrawal of accumulated pension wealth due to the death of a subscriber. Follow these steps to ensure that you accurately complete the form and submit it effectively.

Follow the steps to successfully fill out the India Form 103-GD online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section A, which requires the subscriber’s details. Provide the PRAN number, full name as per the PRAN card, the name of the father or spouse, and the date of birth and date of death of the deceased subscriber. Ensure to enter all names in capital letters.

- Proceed to Section B to fill in the details of the claimant. This includes the claimant’s name, current communication address, date of birth, and relationship with the subscriber. If the claimant is a minor, fill in the guardian's details.

- In Section C, enter the claimant's bank details. This includes choosing the type of bank account, providing the bank account number, branch, and other required banking information. Ensure to attach the necessary proof for electronic transfer.

- Read and complete the Declaration section carefully. Sign the form where indicated, ensuring that if the claimant is a minor, the guardian signs on their behalf. Include a self-attested photograph of the claimant or guardian.

- Attach all required documents, such as the death certificate, PRAN card, and any other identification or proof of relationship as outlined in the form's instructions.

- Review all filled sections for accuracy and completeness before saving your changes. You can then download, print, or share the digitally filled form as per your needs.

Start filling out the India Form 103-GD online today to ensure timely processing of your claim.

In Florida, anyone who owns tangible personal property used in a business must file a tangible personal property tax return. This applies to individuals, corporations, and partnerships alike, ensuring they report the value of their property. If you need assistance with the filing process, resources similar to the India Form 103-GD may be beneficial.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.