Loading

Get In Form No 10fa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form No 10FA online

Filling out the IN Form No 10FA online can be a straightforward process when approached step-by-step. This guide provides the necessary instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the IN Form No 10FA online.

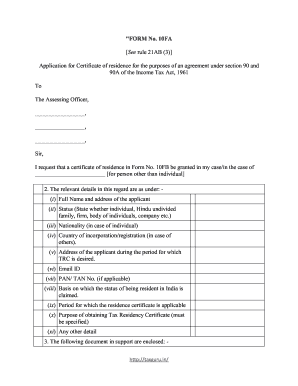

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the form by providing your full name and address in the specified fields. Ensure that all information is accurate and matches your official documents.

- Indicate your status by selecting the appropriate option: whether you are an individual, a Hindu undivided family, a firm, a body of individuals, or a company.

- If you are an individual, state your nationality in the designated space.

- For organizations or firms, enter the country of incorporation or registration in the relevant field.

- Provide your address during the period for which the Tax Residency Certificate (TRC) is requested.

- Fill in your email address to facilitate communication regarding your application.

- Input your Permanent Account Number (PAN) or Tax Deduction and Collection Account Number (TAN), if applicable.

- Explain the basis on which you claim to be a resident in India, providing clear and concise reasoning.

- Specify the period for which the certificate of residence is applicable.

- Clearly state the purpose for obtaining the Tax Residency Certificate, as this must be specified.

- Include any other relevant detail that may be necessary to support your application.

- Attach any supporting documents required as evidence, which may include tax-related documents or identification.

- In the verification section, provide your full name in block letters and your relationship or designation if you are applying on behalf of another person.

- Complete the verification date and the place of verification accurately.

- Sign the form in the designated area and ensure your name is printed clearly below your signature.

- After completing the form, review all entered information for accuracy. Save changes, then download, print, or share the form as needed.

Start filling your IN Form No 10FA online today to ensure a smooth application process.

To apply for a Tax Clearance Certificate (TCC) online in India, visit the official Income Tax India e-filing website. You will need to complete the application form and upload necessary documents. Providing accurate information related to your tax obligations helps streamline the process, which can be easier with solutions from uslegalforms, ensuring you have the right templates at your disposal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.