Loading

Get Ie Rtso1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE RTSO1 online

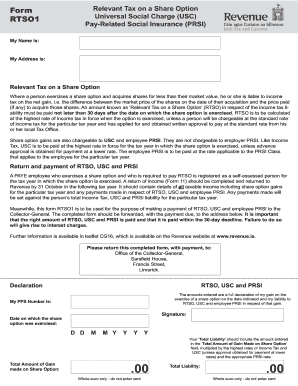

The IE RTSO1 form is essential for reporting and paying relevant tax on a share option exercised by individuals. This guide will support users, regardless of their legal experience, in completing the form accurately to ensure compliance with tax obligations.

Follow the steps to complete the IE RTSO1 form online

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Fill in your personal details including your name and address in the designated fields.

- Provide the date on which the share option was exercised, ensuring the correct format is used.

- Enter your PPS number in the specified area, as it is crucial for identification purposes.

- Calculate the 'Total Amount of Gain Made on Share Option' by determining the difference between the market price and the price paid for the shares.

- Apply the appropriate tax rates to calculate your 'Total Liability' based on the gain reported in the previous step.

- Review all information for accuracy before finalizing your submission.

- After completing all fields, save changes, then proceed to download, print, or share the form as needed.

Complete your IE RTSO1 form online today to meet your tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing an income tax return in Ireland involves several steps, beginning with assessing your income and gathering relevant documentation. You can file either online through the Revenue Online Service (ROS) or via paper forms. To ensure a smooth process, consider utilizing resources from platforms like uslegalforms, especially if your situation connects with IE RTSO1.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.