Loading

Get Ie Form 11 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form 11 online

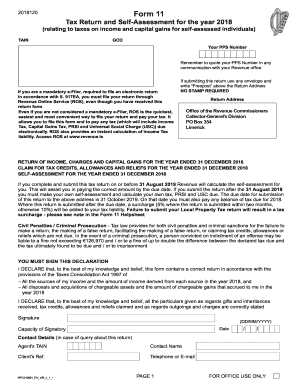

Filling out the IE Form 11 online is essential for self-assessed individuals to report their income and claim tax credits. This guide provides a clear, step-by-step approach to successfully complete the form, ensuring you capture all necessary information accurately.

Follow the steps to complete the IE Form 11 online.

- Click the ‘Get Form’ button to obtain the IE Form 11 and open it in your preferred online editor.

- Begin with the section on personal details. Enter your name, PPS number, and other relevant identification information as required.

- Proceed to the income details page. Here, list all sources of income from trades, pensions, or other relevant incomes, ensuring you specify the amounts accurately.

- For each income source, provide details on expenses you wish to claim, which may include business expenses, allowable deductions, and any tax credits.

- Complete the sections regarding capital gains and liabilities, ensuring to list any chargeable gains or losses incurred during the tax year.

- In the self-assessment section, calculate your total income tax due. Be sure to factor in any existing tax credits or reliefs.

- Review the form thoroughly for any omissions or inaccuracies. Make any necessary changes to ensure accuracy.

- Once complete, you can save the changes, download a copy for your records, or print it for submission.

Now that you understand how to fill out the IE Form 11 online, start your application to ensure you meet the tax deadlines.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can obtain tax return forms, including the IE Form 11, from the official IRS website. Alternatively, platforms like UsLegalForms offer easy access to a variety of tax forms, ensuring you get the latest versions. Simply visit their website, and you can download or print the forms you need. This makes your tax preparation process much smoother.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.