Loading

Get Id Dgt 2 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID DGT 2 online

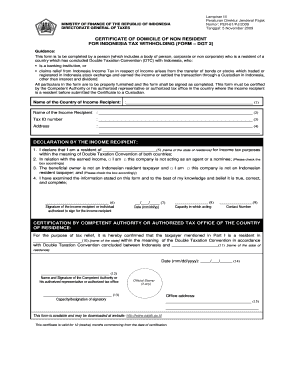

Filling out the ID DGT 2, the certificate of domicile for non-residents regarding Indonesian tax withholding, can seem daunting. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently, ensuring you understand each section and field.

Follow the steps to fill out the ID DGT 2 online.

- Click ‘Get Form’ button to access the ID DGT 2 form and open it in your editing environment.

- In the first field, enter the name of the country of the income recipient.

- In the second field, provide the full name of the income recipient.

- Fill in the income recipient’s taxpayer identification number as registered in their country of residence.

- Complete the address of the income recipient in the designated area of the form.

- In the declaration section, confirm you are a resident of the state mentioned, filling in the relevant country name.

- Determine if you or your company is acting as an agent or nominee, checking the appropriate box.

- Indicate whether the beneficial owner is an Indonesian resident taxpayer by checking the corresponding box.

- Review the information you've provided on the form for accuracy, then sign in the signature area provided.

- Record the date of signing in the specified format.

- Provide details regarding your capacity or designation in the respective field.

- Add your contact number in the relevant section of the form.

- For the certification section, have the competent authority or authorized tax office complete the necessary information and sign the form.

- Fill in the date of certification by the competent authority in the designated area.

- Finally, enter the office address of the competent authority or authorized representative.

- Once all sections are complete and verified, save your changes. You may download, print, or share the form as needed.

Complete and submit your ID DGT 2 online to ensure timely processing of your tax relief.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain a U.S. tax residency certificate, you must demonstrate that you meet the criteria outlined by the Internal Revenue Service (IRS). Typically, this involves submitting Form 8802 alongside required documentation proving your residency status. Utilizing services like US Legal Forms can streamline this process, providing access to relevant forms and guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.