Get Canada T2220 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2220 online

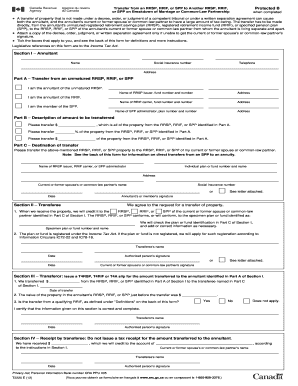

The Canada T2220 form is essential for individuals transferring property from their registered retirement savings plan (RRSP), registered retirement income fund (RRIF), or specified pension plan (SPP) on the breakdown of marriage or common-law partnership. This guide will provide you with clear, step-by-step instructions on how to fill out this form online, ensuring that all necessary information is correctly entered.

Follow the steps to complete the Canada T2220 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section I, provide your name, social insurance number, telephone number, and address as the annuitant.

- In Part A, indicate your status as the annuitant of the unmatured RRSP, RRIF, or SPP by checking the appropriate boxes and providing the name and address of the RRSP issuer, RRIF carrier, or SPP administrator.

- In Part B, specify the amount to be transferred. Indicate either the total amount or the percentage of the property being transferred.

- In Part C, provide the name of the RRSP issuer, RRIF carrier, or SPP administrator receiving the transferred property along with their individual plan or fund number and address.

- Include the name and social insurance number of your current or former spouse or common-law partner.

- Sign Section I to certify the request and have the current or former spouse or common-law partner sign as well if applicable.

- Navigate to Section II, where the transferee must complete and sign their portion, confirming the crediting of the transferred property. This section should also be signed by the current or former spouse or common-law partner.

- In Section III, the transferor must complete and sign this section, issuing the necessary tax slips for the transfer.

- Section IV confirms receipt of the transfer by the transferee, who must complete and sign this section as well.

- Finally, review the form for accuracy, then save your changes, download, print, or share the completed document.

Complete your form online to ensure a smooth property transfer.

Get form

Yes, you can transfer RRSP funds to your wife, but specific rules apply. You may transfer the amounts on a tax-deferred basis, meaning you won’t face immediate tax penalties. Such transfers often support better retirement planning within a spousal RRSP framework and can simplify your overall financial picture. Thus, keep the Canada T2220 in mind, as it directly relates to how you manage these transfers.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.