Get Canada T778 E 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T778 E online

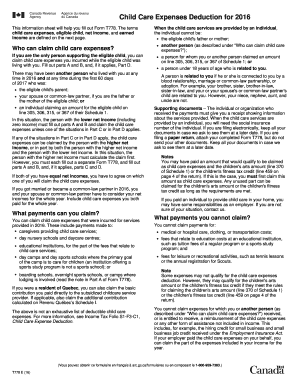

This guide provides comprehensive instructions on completing the Canada T778 E form for child care expenses deductions. Designed to assist users with varying levels of experience, it offers clear, step-by-step guidance for filling out the form accurately and efficiently.

Follow the steps to complete the Canada T778 E form online.

- Click 'Get Form' button to obtain the Canada T778 E form and open it in your preferred online editor.

- Begin by entering the first and last names along with the dates of birth of all eligible children in Part A, even if no expenses were incurred for all of them.

- List all child care expenses paid in the designated section under Part A, including the name of the child care organization or individual and their social insurance number.

- In Part B, complete the basic limit for child care expenses by indicting the number of eligible children and calculating the total expenses based on provided instructions.

- Determine your earned income for the year in Part B, and make sure to follow the guidance provided for reporting income from various sources.

- If applicable, proceed to Part C to indicate whether you are the person with the higher net income, and fill in the details accordingly.

- In Part D, complete the section regarding enrollment in an educational program during 2016 if this applies to your situation.

- Review all entries for accuracy, ensuring no fields are left blank that require input.

- Finally, save your changes, and if necessary, download, print, or share the completed form as needed.

Complete your documents online today for a hassle-free filing experience.

Get form

To claim the Canada caregiver amount, you need to assess your eligibility based on your caregiving responsibilities. This amount can provide significant tax relief for those who support dependents, including children and elderly parents. Make sure to complete the required forms and include the Canada T778 E when applicable. Consulting with a tax expert or using resources like USLegalForms can help simplify the process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.