Get Canada T2 Sch 91 E 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2 SCH 91 E online

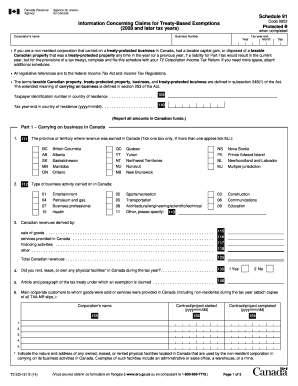

Filling out the Canada T2 SCH 91 E form is essential for non-resident corporations engaged in treaty-protected business activities in Canada. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the T2 SCH 91 E form and open it for editing.

- Begin by entering the tax year-end information. Fill in the year, month, and day in the respective fields.

- Provide the business number and corporation's name in the designated fields.

- Specify the taxpayer identification number in your country of residence as well as the tax year-end in your country, using the appropriate format.

- In Part 1, indicate where the revenue was earned in Canada by ticking the appropriate box for the province or territory.

- Next, select the type of business activity being carried out in Canada by checking one of the listed options.

- Report your Canadian revenues derived from sales, services, and other activities in the relevant fields.

- If applicable, indicate whether you rented, leased, or owned any physical facilities in Canada during the tax year.

- Enter the article and paragraph of the tax treaty under which you claim an exemption.

- List your main corporate customers in Canada, noting the corporation's name and the start and completion dates of contracts/projects.

- Provide details of services offered by employees, including salaries and employment periods for both Canadian and non-resident employees.

- Indicate services provided by subcontractors in a similar manner, detailing payments and periods of service.

- If applicable, specify whether you have applied for a waiver of the withholding requirement and note the response from the Canada Revenue Agency.

- In Part 2, describe any taxable Canadian property disposed of, along with proceeds and costs.

- Finally, ensure you attach necessary forms and documentation as specified. Once completed, you can save changes, download, print, or share the form for submission.

Complete your Canada T2 SCH 91 E form online now to meet your filing requirements.

Taxable capital employed in Canada is separate from retained earnings, although both are essential components of a corporation's financial picture. Retained earnings reflect profit reinvested into the business, while taxable capital employed refers to the total assets used in operations. Clarifying these distinctions is important for effective financial reporting under the guidelines of Canada T2 SCH 91 E.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.