Loading

Get Canada T183 E 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T183 E online

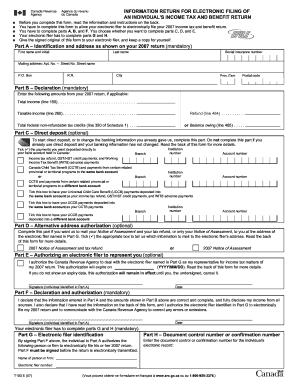

The Canada T183 E form is essential for individuals allowing their electronic filer to submit their income tax and benefit return electronically. This guide will provide comprehensive steps to assist you in filling out this form accurately and efficiently.

Follow the steps to complete the Canada T183 E form online.

- Press the ‘Get Form’ button to acquire the Canada T183 E form and open it in your preferred editor.

- In Part A, fill out your identification and address as reflected on your 2007 return. This includes entering your first name, last name, social insurance number, and your full mailing address.

- Complete Part B by entering the mandatory fields: total income (line 150), taxable income (line 260), either refund (line 484) or the balance owing (line 485), and total federal non-refundable tax credits (line 350 of Schedule 1).

- In Part C, you can opt for direct deposit of your payments. Check the payments you wish to receive directly into your bank account and provide the required banking details including branch and account number.

- Part D is for those who want to authorize an alternative address for their Notice of Assessment and tax refund. Tick the appropriate box to indicate which information should be mailed to the electronic filer’s address.

- If you wish to authorize someone to represent you for your income tax matters, complete Part E. Provide the expiry date of this authorization and ensure to sign it.

- For the mandatory Part F, sign and date to declare that the information provided in Parts A and B is complete and correct. This also authorizes your electronic filer to submit your return.

- Ensure that your electronic filer completes Parts G and H before submission, which includes their identification information and document control number.

- Finally, review all the information filled in the form for accuracy, save your changes, and proceed to download, print, or share the completed form as required.

Begin filling out your Canada T183 E form online today for a seamless tax return experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Eligibility for the $300 federal payment in Canada typically includes residents who meet specific income criteria set by the government. This program aims to support those in financial distress, so ensure you consult the guidelines to know whether you qualify. Submitting your tax forms correctly, including the Canada T183 E, will help in the assessment of your eligibility.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.