Loading

Get Canada T1213(oas) E 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1213(OAS) E online

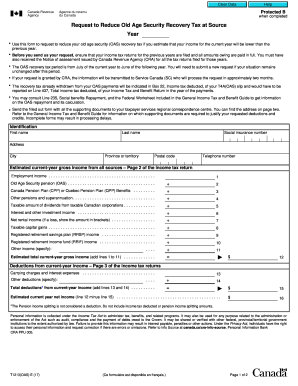

This guide provides step-by-step instructions on completing the Canada T1213(OAS) E form online. Designed to assist users in navigating the required fields and components, this resource ensures a smooth submission process.

Follow the steps to complete your T1213(OAS) E form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred tool.

- Begin with filling in your personal identification details. Input your first name, last name, and social insurance number. Ensure all fields are accurate to avoid processing delays.

- Provide your current address, including city, province or territory, and postal code. This information is crucial for correspondence regarding your request.

- Enter your estimated current-year gross income from all sources. You will need to summarize your employment income, Old Age Security pension, Canada Pension Plan or Quebec Pension Plan benefits, and other sources of income. Make sure to add each category correctly to arrive at your total current-year gross income.

- Detail any deductions from your current-year income. List carrying charges and any other specified deductions accurately to ensure correctness.

- Complete the non-refundable tax credits section. Indicate whether you will claim disability amounts, medical expenses, charitable donations, and any other relevant credits. This information can impact your request.

- Fill in the refundable tax credits section, specifying tax deducted from various sources. This will help in calculating your total refundable tax credits.

- Review all sections thoroughly for completeness and accuracy. Mistakes or omissions may lead to delays in processing your request.

- In the certification section, confirm that the information provided is accurate and complete. Sign and date the form as required.

- Finally, submit your completed form and all supporting documents to the appropriate taxpayer services regional correspondence centre. Ensure that you refer to the General Income Tax and Benefit Guide for specific document requirements.

Start filling out your T1213(OAS) E form online today to facilitate your financial planning.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can apply online for Old Age Security (OAS) in Canada. The Government of Canada provides an online application through its official website, making it convenient for you. Submitting your application online also streamlines the process and can expedite your benefits related to Canada T1213(OAS) E. For further ease, consider using resources available on uslegalforms to guide you in the application process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.