Loading

Get Canada T106 E 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T106 E online

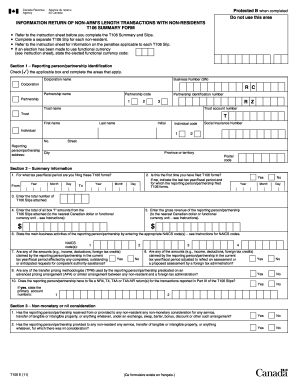

Filling out the Canada T106 E form is essential for reporting non-arm's length transactions with non-residents. This guide provides clear, step-by-step instructions to help you complete the form effectively online.

Follow the steps to fill out the Canada T106 E form correctly.

- Press the ‘Get Form’ button to obtain the T106 E form and open it in your preferred editing tool.

- Begin by filling out Section 1, which includes the reporting person or partnership identification. Provide your Business Number (BN), name, and address. Check the applicable box for your entity type (corporation, partnership, or trust).

- Complete Section 3 by answering questions related to non-monetary or nil consideration in your transactions. Provide accurate details about any services or properties exchanged.

- Once all sections are completed, review the information for accuracy. Prepare to certify the document by providing the contact person's name, telephone number, and signature in the certification section.

- Finally, save your changes, and then download or print the completed T106 E form for submission. Ensure that you file the form according to the deadlines set by the Canada Revenue Agency.

Complete your T106 E form online today to ensure compliance with Canadian regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The new $7500 tax credit in Canada is designed to assist individuals and families in reducing their overall tax burden. This credit can benefit those who qualify, providing a financial boost during tax season. To fully leverage this opportunity, understanding the eligibility criteria and how it integrates with forms like the Canada T106 E is essential.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.