Get Canada T1036 E 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1036 E online

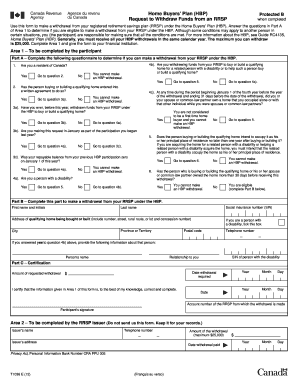

The Canada T1036 E form is essential for individuals who wish to withdraw funds from their registered retirement savings plan under the Home Buyers' Plan. This guide provides a comprehensive and user-friendly approach to help users navigate the process of filling out the form online with clarity and ease.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Area 1, Part A, answer the questionnaire to determine eligibility for a withdrawal. Questions will address residency in Canada, agreement for home purchase, previous withdrawals, and intention to occupy the home.

- In Part B, fill in your personal details, including your social insurance number, name, address of the qualified home, and contact details. If applicable, provide additional information for a related person with a disability.

- Complete the certification section by stating the amount of requested withdrawal (up to $25,000) and the date the withdrawal is required.

- Sign the form to certify the accuracy of the information provided. Ensure all required fields are filled before finalizing.

- Once all information is entered, save changes to the form. Users may also download, print, or share the completed document as needed.

Complete your Canada T1036 E form online today to initiate your Home Buyers' Plan withdrawal.

Get form

Eligibility for RRSP in Canada generally includes individuals who have earned income and file a tax return. You must be a Canadian resident, and the contributions you make can be deducted from your taxable income. Additionally, contributions are tax-deferred until withdrawal, making it a valuable tool for retirement planning. For more specific eligibility criteria and guidance, you might find the Canada T1036 E form beneficial in understanding your options.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.