Loading

Get Canada Rc145 E 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC145 E online

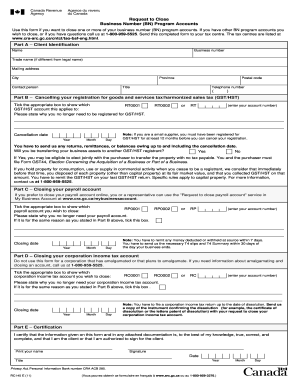

Filling out the Canada RC145 E form is a crucial step for individuals and businesses looking to close their business number program accounts. This guide will provide clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the Canada RC145 E form.

- Click ‘Get Form’ button to access the Canada RC145 E form and open it in your preferred digital environment.

- In Part A – Client Identification, enter your name, business number, trade name (if it differs from your legal name), mailing address, city, province, postal code, contact person, title, and telephone number.

- Proceed to Part B – Cancelling your registration for goods and services tax/harmonized sales tax (GST/HST). Select the appropriate GST/HST account by ticking the corresponding box and provide the reason for cancellation.

- Fill in the cancellation date, ensuring the format is year, month, and day. If applicable, indicate whether you are transferring your business assets to another GST/HST registrant.

- Move to Part C – Closing your payroll account. Indicate the payroll account you wish to close by ticking the appropriate box. State the reason for closing and fill in the closing date.

- In Part D – Closing your corporation income tax account, select the account to close by ticking the relevant box. Provide the reason for closing and the closing date.

- Complete Part E – Certification by printing your name, signing the form, and adding the date and title. Ensure that all information is true and correct.

- After filling out the form, review all entries for accuracy. You can then save your changes, download, print, or share the completed form as necessary.

Complete your documents online with confidence today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To call a 1-800-number from outside Canada, first dial 1-800-000-0000 and then follow with the 800 number. Note that some 1-800 numbers may not be reachable from outside Canada, so it’s wise to check beforehand. As an alternative, some companies may provide specific international numbers. For detailed instructions, Canada RC145 E has relevant insights on making such calls.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.