Get Canada Mep2388 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Canada MEP2388 online

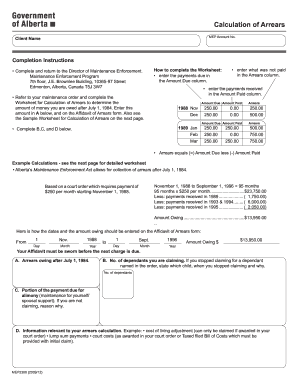

The Canada MEP2388 form is essential for calculating arrears owed within the Maintenance Enforcement Program. This guide will provide step-by-step instructions on how to complete and submit the form online, ensuring accuracy and efficiency in your filing process.

Follow the steps to fill out the Canada MEP2388 online effectively.

- Click ‘Get Form’ button to access the MEP2388 form and open it in the editor.

- Enter your MEP account number in the designated field at the top of the form.

- Fill in your name in the 'Client Name' section to identify your case.

- Locate the section for the worksheet titled 'Calculation of Arrears'. Here, you will enter the payments due in the 'Amount Due' column.

- In the 'Arrears' column, record the amounts that have not been paid.

- Input the payments you have received in the 'Amount Paid' column.

- Review your maintenance order and complete the worksheet to determine the total amount owed after July 1, 1984. Enter this total in part A.

- Complete sections B, C, and D for additional information related to dependents, alimony payments, and relevant details concerning your arrears calculation.

- Ensure all calculations are accurate, especially in the 'Example Calculations' provided on the form.

- Once all sections are completed, save your changes, and choose to download, print, or share the form as necessary.

Complete your Canada MEP2388 form online today to ensure proper processing of your arrears.

Canada does not specifically have a W-8 form, as this form is a U.S. tax document designed for non-U.S. persons. However, Canadians may need to use the W8 form when engaging with U.S. entities to claim tax exemptions. The key is to understand the application of this form within the context of U.S. tax regulations. If you would like further insights, uslegalforms can provide comprehensive information to support your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.