Get Canada Gst190 E 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST190 E online

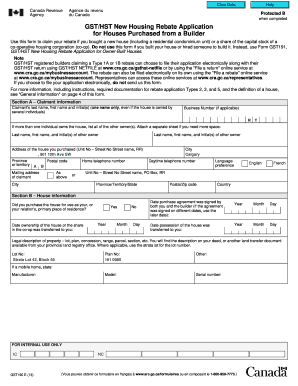

The Canada GST190 E form is designed for individuals who have purchased a new house or a share of capital stock in a co-operative housing corporation. This guide will provide you with clear, step-by-step instructions on how to complete this form electronically, ensuring a smooth application process for your housing rebate.

Follow the steps to complete your GST190 E form online.

- Press the ‘Get Form’ button to obtain the GST190 E form and access it in your preferred online editor.

- Section A – Claimant information: Start by entering your last name, first name, and initials. If the house is co-owned, list other owners as needed. Additionally, provide your business number, contact information, and mailing address.

- Section B – House information: Indicate whether the house will be used as your primary residence. Enter significant dates such as ownership transfer and possession transfer dates, as well as the legal property description.

- Section C – Housing and application Type: Check the appropriate box for your type of housing and application type. Ensure you meet the requirements as outlined in the guide to claim your rebate.

- Section D – Builder or co-op information: Fill in the builder's or co-operative's legal name and business number, along with their address and contact information. Confirm whether the builder paid the rebate directly.

- Section E – Claimant's certification: Review the provided information carefully, then sign and date the certification to confirm accuracy and completeness.

- Section F – Rebate calculation: Depending on your application type, fill out the relevant part of Section F to calculate the rebate amount you are eligible for.

- Section G – Direct deposit request: If applicable, provide your banking information for a direct deposit of any eligible refund.

- Once you have completed all sections accurately, save your changes and the completed form. You may choose to download, print, or share the form as required.

Complete your Canada GST190 E form online today to ensure you receive your housing rebate.

Get form

Yes, US citizens can claim back GST on certain eligible purchases made during their visit to Canada. However, they must follow the proper procedures and provide the necessary documentation to support their claim. Understanding the process can prevent errors and ensure a smoother experience. For detailed guidance, checking uslegalforms can provide the information you need.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.