Get Canada 13-502f4 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 13-502F4 online

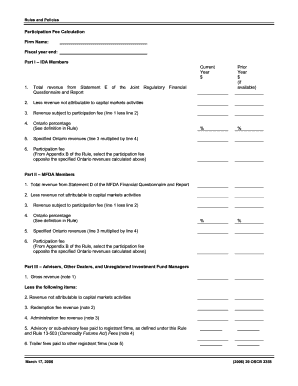

The Canada 13-502F4 form is essential for calculating participation fees for various capital market participants. This guide will provide you with clear, step-by-step instructions on how to accurately complete this form online.

Follow the steps to accurately complete the Canada 13-502F4 form online.

- Click the ‘Get Form’ button to access the Canada 13-502F4 form and open it in your preferred online document editor.

- Identify the correct part to complete based on your membership: IDA members should complete Part I, MFDA members should complete Part II, while unregistered investment fund managers and registrant firms not affiliated with IDA or MFDA should complete Part III.

- Fill in the firm name and fiscal year-end information at the top of the form.

- For Part I (IDA Members), report the total revenue from Statement E of the Joint Regulatory Financial Questionnaire and Report, excluding non-capital markets revenue.

- In Part I, calculate the revenue subject to participation fee by subtracting non-attributable revenue from total revenue.

- Determine the Ontario percentage based on the company’s allocation rate used in their corporate tax return and calculate specified Ontario revenues.

- Complete Part II (MFDA Members) by reporting total revenue from Statement D of the MFDA Financial Questionnaire, following similar steps to those in Part I.

- In Part III, calculate gross revenue and identify all appropriate deductions, including revenue not attributable to capital markets activities, redemption fees, and administration fees.

- For the deductions in Part III, add all deduction items together to find the total deductions and subtract from gross revenue to find revenue subject to participation fee.

- Complete Part IV by having two members of senior management certify the information, providing their names, titles, signatures, and the certification date.

- Once all sections have been filled out, review the information for accuracy, then save any changes, and proceed to download, print, or share the completed form as needed.

Start filling out the Canada 13-502F4 form online today to ensure compliance and accurate fee calculations.

Acquiring Canada sponsorship involves several steps, including finding a Canadian employer or relative willing to sponsor you. You will need to submit an application that meets immigration requirements, showcasing your qualifications and intent. Engaging with platforms that specialize in legal forms, such as USLegalForms, can help ease these processes by providing necessary documentation support aligned with Canada 13-502F4.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.