Get Alberta At1 Schedule 1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alberta AT1 Schedule 1 online

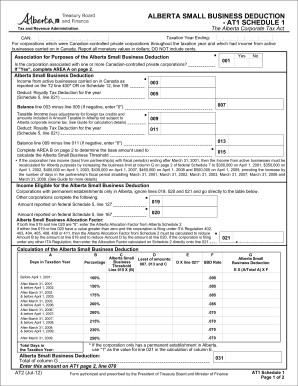

Filling out the Alberta AT1 Schedule 1 form can be straightforward with the right guidance. This document is crucial for Canadian-controlled private corporations wishing to claim the Alberta small business deduction for the taxation year. Follow these clear steps to complete the form online effectively.

Follow the steps to fill out the Alberta AT1 Schedule 1 online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the taxation year ending in the designated field. Ensure that the information matches your business records accurately.

- In the first section, determine if your corporation is associated with one or more Canadian-controlled private corporations by selecting 'Yes' or 'No'.

- If associated, complete AREA A on page 2 to allocate the base amount. Fill in the names of associated corporations, their Alberta corporate account numbers, and the percentage of the business limit.

- Return to page 1 and report the income from active businesses in Canada on the appropriate lines, ensuring you are referencing either T2 line 400 or Schedule 12, line 106.

- Deduct the royal tax deduction for the year as instructed, completing the balance calculations accurately.

- Proceed to AREA B on page 2 to determine the value for line 015, adjusting for any necessary prorations or reductions for large corporations.

- Calculate the Alberta small business deduction by filling in the values based on days in the taxation year and the applicable small business rates.

- Finally, ensure that all calculations are correct and reflect the total of column G as required, before entering this amount on AT1 page 2, line 070.

- Once completed, you can save changes, download, print, or share the form as needed.

Ready to streamline your process? Fill out the Alberta AT1 Schedule 1 online now.

Get form

Filling out a Schedule 1 involves providing various personal and financial details, including income and deductions. Start by gathering all relevant information for accurate reporting. The Alberta AT1 Schedule 1 requires careful attention to detail, so utilize tools like uslegalforms to guide you through the process, ensuring all sections are completed correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.