Loading

Get Canada Treb Form 296 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada TREB Form 296 online

Filling out the Canada TREB Form 296 online can be a straightforward process if you follow the right steps. This guide aims to provide clear, detailed instructions tailored to your needs, ensuring you complete the form accurately and efficiently.

Follow the steps to fill out the Canada TREB Form 296 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

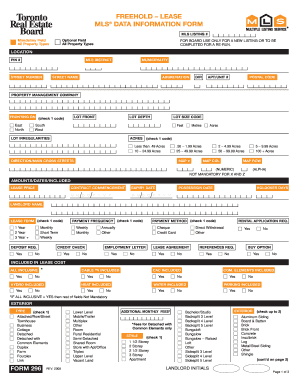

- Begin with the MLS data information section. Enter required details, such as the MLS listing number, property location, and municipal details. Make sure to fill in mandatory fields as indicated.

- In the next section, input details about the property type, such as the lot size and any irregularities. Choose the applicable options from the provided check boxes.

- Fill in the amounts, dates, and lease details. This includes the lease price, contract commencement, expiry date, and any possession date. Ensure accuracy to avoid misunderstandings.

- Continue to provide information regarding the landlord, lease terms, and payment frequency. Select check boxes for deposit requirements and whether a credit check or employment letter is needed.

- Specify details of the lease agreement and whether references are required. Choose any inclusions in the lease cost, such as utilities or amenities.

- Complete the sections about the property’s exterior, garage type, interior features, and any special designations. Check the appropriate boxes relevant to the property.

- Review the comments section to add any remarks for clients or brokerages, ensuring that the information is concise and within character limits.

- Double-check all entered data for accuracy. Once completed, users can save changes, download, print, or share the form as needed.

Start filling out the Canada TREB Form 296 online today to streamline your document management process.

The W-8 form should be filled out by non-U.S. persons receiving income from U.S. sources. This includes foreign individuals or entities that need to establish their foreign status for tax purposes. If you are involved in real estate transactions linked to the Canada TREB Form 296, completing this form is often necessary.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.