Loading

Get Toronto F002074a 2003-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Toronto F002074A online

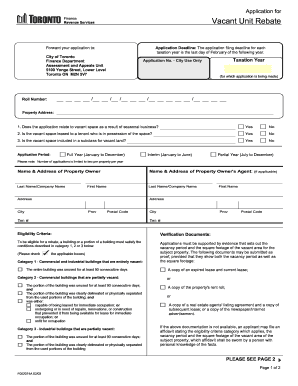

Filling out the Toronto F002074A form is essential for property owners seeking a rebate for vacant commercial and industrial units. This guide offers clear, step-by-step instructions to ensure you complete the application accurately and efficiently.

Follow the steps to complete your application seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill out the roll number and taxation year at the top of the form. This information helps to identify the property and the applicable tax period.

- Provide the property address where the vacant unit is located.

- Indicate whether the application relates to seasonal business by selecting ‘Yes’ or ‘No’.

- State if the vacant space is leased to a tenant in possession by selecting ‘Yes’ or ‘No’.

- Confirm whether the vacant space is included in a subclass for vacant land by selecting ‘Yes’ or ‘No’.

- Select the appropriate application period: Full Year, Interim, or Partial Year.

- Enter the name and address of the property owner, including telephone number.

- If applicable, provide the name and address of the property owner's agent and their telephone number.

- Review the eligibility criteria and consider the verification documents needed to support your application.

- Complete the vacancy information section, detailing the vacant unit/suite number, location, vacancy period, and the square footage.

- Certify the accuracy of the information provided by signing and dating the form. Ensure that both the applicant and property owner signatures are included if applying through an agent.

- Once completed, you can save changes, download, print, or share the form as needed.

Encourage others to complete their forms online for a smoother filing experience.

The vacant home tax in Toronto is currently set at 1% of the property's current value, rather than 3%. This tax applies primarily to unoccupied homes that meet the city's criteria. Understanding this tax can guide homeowners in making informed decisions about using their properties. For further insights on Toronto F002074A, consider exploring official resources or trusted platforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.