Loading

Get Canada Lic/gam 5471 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada LIC/GAM 5471 online

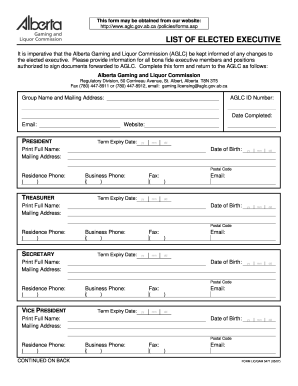

The Canada LIC/GAM 5471 form is essential for providing information on your organization's elected executive to the Alberta Gaming and Liquor Commission (AGLC). This guide will help you navigate the process of completing this form online, ensuring you submit accurate and comprehensive information.

Follow the steps to successfully complete the Canada LIC/GAM 5471 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your group name and mailing address in the designated fields.

- Provide your AGLC ID number and indicate the date you completed the form.

- Fill out the section dedicated to the president, including their term expiry date, full name, mailing address, date of birth, and contact information such as residence phone, business phone, and fax.

- Continue to the sections for the treasurer, secretary, vice president, and other positions, completing the same information for each, including term expiry date, full name, mailing address, date of birth, and contact details.

- If applicable, add any additional positions held by executive members, ensuring that you complete all requested fields.

- Review all entries for accuracy, making any necessary corrections.

- Finally, you can save your changes, download the completed form, print it, or share it as needed.

Complete your Canada LIC/GAM 5471 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can indeed file form 5471 separately, which is an important option for U.S. persons with interests in foreign corporations. It’s crucial to adhere to IRS guidelines and provide accurate, complete information to avoid issues. Resources from uslegalforms can make the filing process of Canada LIC/GAM 5471 more straightforward and manageable.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.