Loading

Get Au Nat 5367 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 5367 online

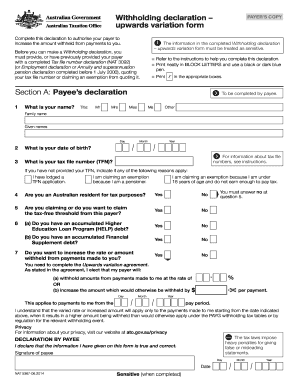

This guide provides a clear and supportive overview of how to fill out the AU NAT 5367 online, known as the withholding declaration – upwards variation form. By following the step-by-step instructions, you can ensure that your information is accurately submitted to increase the amount withheld from your payments.

Follow the steps to complete the withholding declaration online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in Section A, which is the payee's declaration. Start by entering your name, including your title, family name, and given names.

- Input your date of birth, ensuring you provide the day, month, and year.

- Enter your tax file number (TFN). If you do not have a TFN, indicate the reason by checking the appropriate box.

- State whether you are an Australian resident for tax purposes by selecting 'Yes' or 'No'.

- Indicate if you are claiming the tax-free threshold from this payer by selecting 'Yes' or 'No'.

- Answer whether you have an accumulated Higher Education Loan Program (HELP) debt and a Financial Supplement debt.

- Decide if you want to increase the rate or amount withheld from payments made to you by selecting 'Yes' or 'No'. If 'Yes', complete the upward variation agreement.

- For the upward variation, specify the new withholding rate or the increased amount from payments made to you, including the applicable date.

- Sign and date the declaration, confirming that the information provided is true and correct.

- Once completed, save the form, and if necessary, download or print it for your records, following the outlined privacy instructions.

Complete your AU NAT 5367 online today to ensure proper withholding from your payments.

The self-declaration form serves as a means for individuals to confirm their tax status and other relevant information to tax authorities. This transparency helps ensure compliance and proper assessment of tax liabilities. Utilizing the guidelines outlined in AU NAT 5367 can enhance the accuracy of your self-declaration process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.