Get Au Nat 3346 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 3346 online

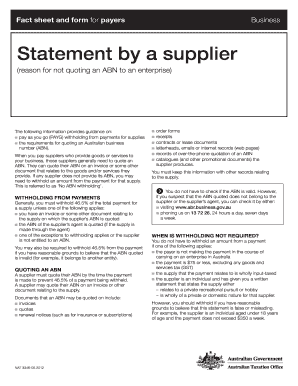

The AU NAT 3346 is an important form for suppliers who need to communicate their reason for not quoting an Australian business number (ABN) when providing goods or services. This guide offers step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the AU NAT 3346 form online effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your details in Section A. Write your full name and address, ensuring you include your suburb or town, state or territory, and postcode. Use clear block letters and a black pen.

- In Section A, indicate your reason for not quoting your ABN by placing an X in the appropriate boxes. Options include reasons like the payment being under $75 or that the supplier does not carry on an enterprise in Australia.

- Proceed to Section B: Declaration. Here, provide the name of the supplier or authorized person, and ensure they sign the declaration.

- Fill in your daytime phone number and the date of completion, making sure to write it in the correct format (day, month, year).

- Review all entered information for accuracy and clarity.

- Once all fields are completed, you can save your changes, download, print, or share the form as needed.

Complete your AU NAT 3346 form online today for a smoother process!

Get form

Determining what to put for your withholding allowance requires an understanding of your individual tax situation. Generally, you may want to consider factors such as your income level, number of dependents, and any potential tax credits. Leveraging tools and resources from platforms like uslegalforms can help guide you through the process while ensuring compliance with guidelines such as those associated with the AU NAT 3346.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.