Loading

Get Au Dh1054b 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU DH1054B online

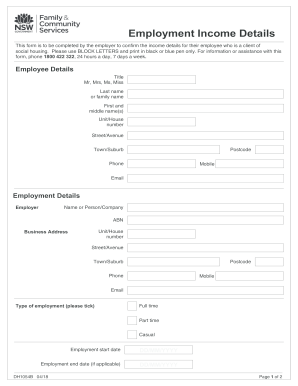

The AU DH1054B form is essential for employers to confirm the income details of employees who are clients of social housing. This guide provides clear and supportive instructions for completing the form online.

Follow the steps to successfully complete the AU DH1054B form.

- Click the ‘Get Form’ button to access the AU DH1054B form and open it for editing.

- Begin by entering the employee details. Fill in the title, last name, first and middle names, and contact information, including the unit/house number, street/avenue, postcode, phone, mobile, and email.

- Proceed to the employment details section. Record the employer's name or the company name, their ABN, and business address, including the unit/house number, street/avenue, town/suburb, postcode, phone, mobile, and email.

- Indicate the type of employment by ticking the appropriate box: full time, part time, or casual. Enter the employment start date and, if applicable, the employment end date using the format DD/MM/YYYY.

- Document the period of employment over the past 26 weeks. Then, fill in the income details, beginning with the pay period start and end dates. Ensure to include the gross salary or wages for the specified period, accounting for any salary sacrifices, allowances, or fringe benefits.

- Enter the current gross (before tax) weekly wage and the amount of salary sacrifice per week, along with relevant definitions for salary sacrifice, any monetary reimbursement for travel expenses during the past 26 weeks, the amount of fringe benefits, deductions, and allowances per week.

- Include the number of days lost without pay. Lastly, the employer's representative must print their name, provide a signature, affix the company stamp or seal if required, enter the ABN, and date the form.

- After completing the form, save your changes, and then you can download, print, or share the filled-out AU DH1054B form as needed.

Complete your documents online today with confidence.

Form 8332 is typically submitted by the custodial parent or the one claiming the child as a dependent for tax purposes. This form allows the custodial parent to give up their right to claim the child, enabling the non-custodial parent the opportunity to claim the child on their tax return. For further support using AU DH1054B, the US Legal Forms platform offers valuable tools and resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.