Loading

Get Sf-ppr-e 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SF-PPR-E online

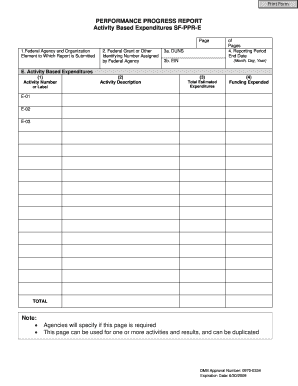

The SF-PPR-E is a crucial document used to report performance progress in relation to federal grants. This guide will help users understand the necessary steps to accurately complete the form online, ensuring that all required information is provided clearly and effectively.

Follow the steps to complete the SF-PPR-E form online.

- Click the ‘Get Form’ button to access the SF-PPR-E. This action will open the form in your chosen editing interface.

- In section 1, enter the name of the federal agency and organizational element to which the report is being submitted. This information is typically outlined in the award document.

- In section 2, provide the federal grant or identifying number assigned by the awarding federal agency. This number is found in the official documentation related to your grant.

- For section 3a, input the DUNS number of the recipient organization. This number is crucial for identifying your organization in federal databases.

- In section 3b, enter the Employer Identification Number (EIN) as assigned by the Internal Revenue Service, which is needed for tax-related purposes.

- Section 4 requires you to specify the reporting period end date. This date should align with the reporting specifications provided in your grant documentation.

- In the Activity Based Expenditures section E, begin by entering the activity number or label in field (1) which tracks a particular awarded activity.

- Field (2) is for the activity description, where you will describe the awarded activities that were performed and are related to your expenditures.

- For field (3), enter your total estimated expenditures for each activity during the project period.

- Finally, in field (4), record the actual funding expended for each activity, ensuring the figures correspond with your financial records.

- After completing the form, remember to review all entries for accuracy. You can then save changes, download, print, or share the completed form as needed.

Complete your documents online today to streamline your reporting process.

Entities receiving federal funds are typically required to file the SF-425, which reports on financial and programmatic progress. This requirement ensures transparency and accountability in the use of federal funds. By using SF-PPR-E, organizations can manage their reporting responsibilities more effectively and maintain compliance with federal regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.