Get Usda Rd 1980-19 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USDA RD 1980-19 online

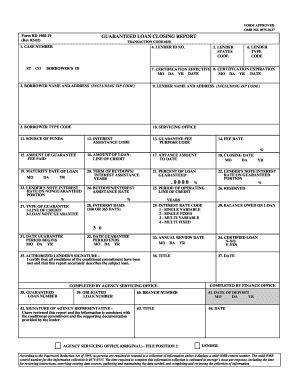

The USDA RD 1980-19 form, known as the guaranteed loan closing report, is an essential document for processing loan transactions. This guide will provide you with step-by-step instructions for completing this form online, ensuring that you have all necessary information at hand.

Follow the steps to successfully complete the USDA RD 1980-19 form online.

- Use the ‘Get Form’ button to access the USDA RD 1980-19 form and open it in your preferred editing tool.

- Enter the case number in the designated field to identify your loan transaction.

- Fill in the borrower's name and address, ensuring that you include the correct ZIP code.

- Specify the type code for the borrower in the appropriate section.

- Input the lender ID number, along with the lender's name and address, including the ZIP code.

- Select the lender status and type code from the options provided.

- Provide the certification effective date and expiration date using the designated format.

- Indicate the servicing office responsible for the loan.

- List the source of funds used in the transaction.

- Identify the interest assistance code applicable to the situation.

- Fill in the guarantee fee purpose code and fee rate as required.

- Specify the amount of guarantee fee paid alongside the amount of the loan line of credit.

- Enter the advanced amount to date and the applicable closing date.

- Fill in the maturity date of the loan and the total term of the buydown or interest assistance in years.

- State the percentage of the loan that is guaranteed.

- Input the lender's note interest rate on the guaranteed and nonguaranteed portions.

- Specify the buydown or interest assistance rate and indicate the type of guarantee being applied.

- Confirm the interest basis (360 or 365 days) and interest rate code.

- Enter the balance owed on the loan and the dates for the guarantee period.

- Include the annual review date where required.

- Authenticate the report with the authorized lender’s signature, title, and completion date.

- Ensure the agency representative’s signature is captured along with the review date.

- Finalize the report by saving your changes. You may also download, print, or share the completed form as necessary.

Complete your USDA RD 1980-19 form online today and ensure a seamless loan processing experience.

After underwriting, USDA approval typically takes anywhere from a few days to a couple of weeks, depending on various factors. The overall timeline can vary based on the lender's processing efficiency and the complexity of your application. Understanding this process helps you plan your home buying journey more effectively. Don’t hesitate to utilize USLegalForms to ensure your paperwork is in order, potentially speeding up your approval timeline.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.