Get Usda Fsa-2330 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USDA FSA-2330 online

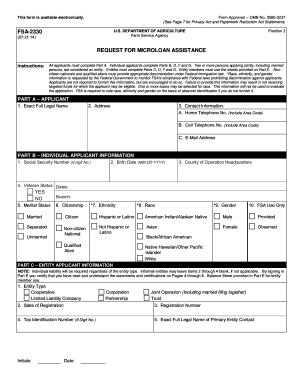

The USDA FSA-2330 is a request form for microloan assistance, designed for individuals and entities seeking financial support in agricultural ventures. This guide provides comprehensive, step-by-step instructions to help users complete the form with confidence and clarity.

Follow the steps to fill out the USDA FSA-2330 effectively

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part A, where you will enter your exact full legal name, address, and contact information including home and cell telephone numbers, as well as an email address.

- For individual applicants, complete Part B with your social security number, birth date, county of operation, veteran status, marital status, citizenship, ethnicity, race, and gender.

- If applying as an entity, fill out Part C with the entity type, state of registration, registration number, tax identification number, and the primary contact's legal name.

- Proceed to Part D, where you will detail projected annual income and expenses, along with assets and debts. Ensure to provide specific amounts for each category.

- If applicable, complete Part E with information about each entity member including their ownership percentage, income details, and related financial information.

- In Part F, describe the counties being farmed, acreage owned and rented, loan purpose, and the amount requested. Provide additional information about your farming operation and training.

- Review and complete Part G to answer questions regarding previous loans, obligations, and certifications. Provide any required additional details.

- Finally, ensure you complete the required signatures and dates in the certification section before submitting the form.

- Once the form is fully completed, you can save your changes, download, print, or share the form as needed.

Take the next step towards your agricultural goals by completing the USDA FSA-2330 online today.

Get form

Failing a USDA inspection often results from critical issues like non-compliance with health standards, improper handling of food, or poor facility maintenance. Ensuring that operations align with USDA FSA-2330 guidelines is vital for passing inspections smoothly. Understanding the common pitfalls can help you maintain compliance and avoid setbacks. For more detailed insights, rely on resources from uslegalforms to prepare appropriately.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.