Get Rd 1980-18 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RD 1980-18 online

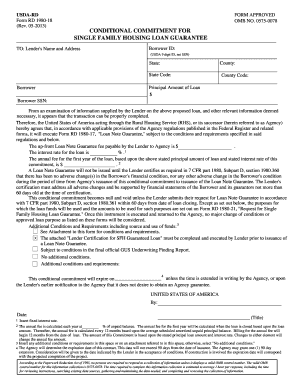

Filling out the RD 1980-18 online can streamline the application process for a single-family housing loan guarantee. This guide provides a step-by-step approach to ensure you complete this form accurately and efficiently.

Follow the steps to fill out the RD 1980-18 online.

- Press the ‘Get Form’ button to access the RD 1980-18 form and open it in the online editor. Ensure you have a reliable internet connection to avoid interruptions.

- In the 'Lender's Name and Address' section, input the full name and address of the lender as required.

- Enter the 'Borrower ID' using the USDA 9-digit identification number. Do not use the Social Security Number.

- Fill in the 'County' and 'State' along with the corresponding state code. This information helps identify the local jurisdiction for the loan.

- Specify the 'Principal Amount of Loan' by entering the amount in dollars that is being requested for the loan guarantee.

- In the 'Borrower SSN' field, provide the Social Security Number of the borrower to verify their identity.

- Review the additional sections regarding the loan details, including the Loan Note Guarantee fee and the interest rate. Input the appropriate amounts based on the details provided by the lender.

- Carefully read the conditional commitment requirements and additional conditions, ensuring all necessary information is accurate and up-to-date.

- Before submission, ensure that the form is complete. Save your changes to keep a record of your input.

- Once finalized, you can download, print, or share the form directly from the online editor for processing.

Complete the RD 1980-18 form online to expedite your loan guarantee application process.

Form RD 1980-19 is a significant document used in conjunction with RD 1980-18. It provides the necessary information for those seeking loans or grants under the USDA Rural Development program. By understanding RD 1980-18, you can better navigate the requirements outlined in Form RD 1980-19, ensuring that you meet all criteria for assistance. For complete guidance, consider using the US Legal Forms platform, as it offers resources and templates that streamline the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.